New electoral funding scheme in the works, first meeting held to discuss potential plan

Responding to a question at the India Today Conclave on barring loss-making and shell companies from political funding, Finance Minister Nirmala Sitharaman had said: "There are issues on that front. We need to look into them. You cannot have shell companies and loss-making companies doing this." Key Points

Business TodayEven for long-term investors, putting more checks and balances is the key: 4 largecap stocks with upside p

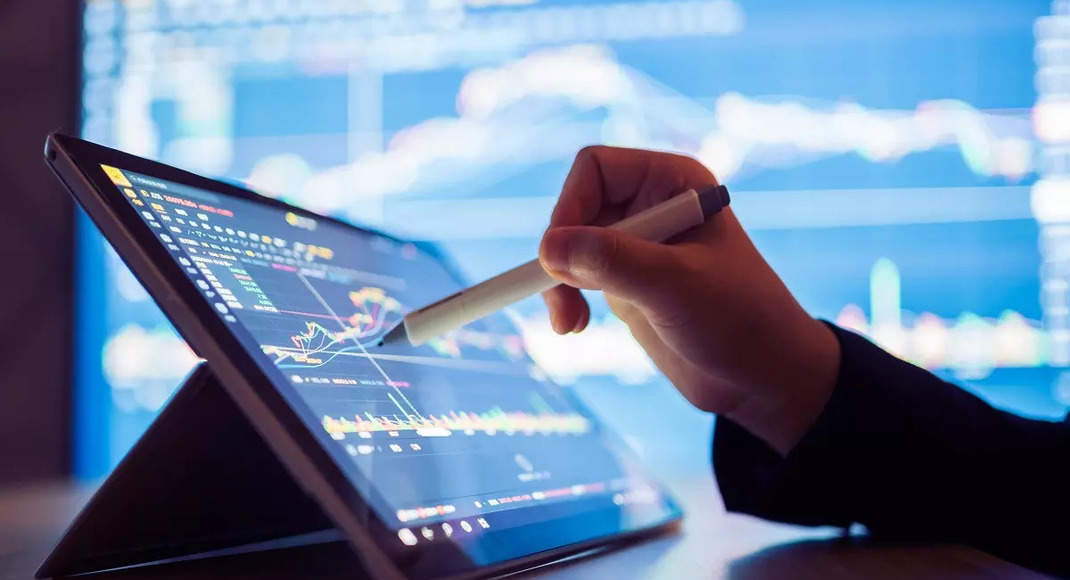

While Nifty and Sensex have seen some respite and given the fact that few mega stocks have the ability to push indices even higher, one cannot rule out the possibility of reading the headlines “ nifty forms a new high” very soon. But as we have seen in the recent past, what nifty does and what is happening in the broader market can be very different. So, it would be better to focus on what is happening in sectors and companies, are there some tailwinds that are likely to lead to better overall growth of the sector and hence the companies. Even in those sectors stick with companies that have a proven track record of surviving economic cycles and on financial parameters they are better placed than others. Because it is finally the earnings which will determine whether the stock is able to outperform or underperform broader market indices. We take a look at four stocks where on two parameters, that is net margins and return on equity, the companies are clearly better placed and there are clear sectoral tailwinds. Key Points

Economic TimesIs all the bad news and views priced in ? 4 stocks from the natural gas sector for contrarian trade.

Gas stocks have been underperforming the market for quite some time. The argument against them has been multifold, right from stagnation in terms of volume growth, companies not being able to expand in newer areas and the latest one being the threat from EV. Couple of months back, an announcement about pushing the electric vehicle (EV) more aggressively in Delhi, brought pressure on the stocks like IGL. While there is no doubt that over a period of time, EV will dominate, does it mean the end of the business of the gas companies? The answer is probably no, there are many other use cases and narrative about negative impact might be over stretched. Also the street might be ignoring the fact that these companies have enough cash on the balance sheet and also cash flows from existing lines of business to move into new areas which are part of the EV eco system. Key Points

Economic TimesIn new-age business, market share may not always mean profitability

India's FMCG sector is adapting to digital transformation by investing in digital advertising and engaging in direct-to-consumer trends. Legacy companies face challenges from local brands and digital-first startups as market dynamics evolve. Key Points

Economic TimesNearly 70% IPOs of FY24 trading above issue prices. What lies ahead in FY25?

Fiscal 2024 showcased a vibrant IPO market with 75 companies hitting the Street, including Tata Technologies and IREDA. Strong performances marked the year from the likes of Signature Global and Netweb Technologies. Analysts expect robustness in IPO market to continue. Key Points

Economic Times

Deven Choksey on what he likes about Adani Ports, Torrent Pharma now

Deven Choksey discusses the positive trajectory of Adani Ports, Torrent Pharma's strategic growth approach, and Tata Consumer's market readiness. The evolving market dynamics favor strategic expansions and operational stability for these key players. Choksey further says that automobile ancillaries give a good amount of opportunity at this point of time. Key Points

Economic TimesEU launches probes into Apple, Meta, Google under new digital competition law

Investigations add to regulatory headaches for U.S. tech companies under growing scrutiny worldwide. Key Points

mintIPO Review: 25 companies hit Dalal Street in March with two more set to list; a look at the top performers

March sees 25 new listings on Dalal Street, with SMEs leading the pack. Owais Metal shines with a 368% increase, while Exicom Tele-Systems tops the mainline category with a 51.1% gain. Overall, a total of 76 companies have made their debut on Dalal Street in CY24 thus far. Key Points

mintBhushan Steel money laundering case: Singals caused loss of ₹11,446 cr to financial institutions, alleges

The siphoned-off funds were invested in preference shares of Bhushan Steel Ltd (BSL) in the name of the promoters or in the name of the companies controlled by the promoters, ED alleged. The funds were also being used to purchase properties in the name of the companies, ED said. Key Points

Economic TimesBulk of correction in small, midcaps over; days of IT largecaps are numbered: Nilesh Shah, Envision Capita

Nilesh Shah anticipates largecap IT decline, supports specialised technology services growth. He believes online consumer or the online fintech space are the businesses which are making rapid strides. While acknowledging market froth, advises against tactical allocations. shifting funds from small and midcaps to largecaps Further, Shah emphasizes bottom-up opportunities, energy sector potential, and regulatory risks in the insurance sector. Key Points

Economic Times

India will have 2-3 more semiconductor fabs: S Krishnan

The Ministry of Electronics & IT (MeitY) is aggressively working on boosting the domestic semiconductor industry and responsible use of AI. MeitY Secretary, S Krishnan, discusses the semiconductor ecosystem, mobile components manufacturing, deepfakes, and the implementation of the Digital Personal Data Protection (DPDP) Act 2023. Key Points

Economic TimesTata, Mahindra, Adani or Reliance? Which group could be a big trade in next 3-5 years?

According to Sandip Sabharwal, large group stocks like Tatas, Mahindra Group, Adanis, and Reliance have performed well. He believes if the economy sustains 7-8% growth, many companies and groups will continue to thrive. However, he is cautious about HDFC Bank and warns investors tobe wary of the overvaluation in smallcaps. Key Points

Economic TimesDon't paint them with same brush: 4 NBFCs with strong parentage, 3 with upside potential of up to 25%

It started with RBI asking for higher provision for unsecured credit by NBFC and banks, then the housing finance sector came under the lens and tighter provision for raising debt. Then it was the turn of micro finance companies. But then came action in two companies, in both cases companies were stopped from doing a part of their business. This where the street got jittery and there was a sharp decline in all the NBFC stocks. The reason, the two orders from RBI brought back the memories of 2018, when the RBI action on a private bank and one housing finance company, created a mayhem on the street and all NBFC came under pressure. The question is whether this is the repeat of 2018 ? The answer, probably No. Will there be action on individual companies ? Answer is probably Yes and even more severe. Key Points

Economic TimesExclusive: AI will lead to IT companies needing 70 per cent fewer people, says former HCL CEO Vineet Nayar

These are turbulent times for the IT industry, more so because of the arrival of AI tools like Copilot and ChatGPT. Industry veteran and former CEO of HCL Vineet Nayar says that AI tools will surely impact jobs in coming months and years. Key Points

India TodayFlipkart eyes quick-commerce entry; No point Googling ‘swadeshi’

Flipkart has been working to cut down the timeline of its deliveries across categories for some time now. The firm rolled out same-day delivery of products across several categories at no extra cost from February. Key Points

Economic Times

RBI order on credit card networks; Google billing row unnerves gaming apps

The central banks latest diktat barring exclusive deals between banks and card companies could disrupt their mutually beneficial partnerships. More on this in todays ETtech Morning Dispatch. Key Points

Economic TimesCCI can now impose fines based on cos' global turnover

The Competition Commission of India can now impose penalties on companies based on their global turnover. The amendment is likely to have major implications on multi-product companies and those with global operations, leading to the use of settlements or commitments to avoid steep penalties. Key Points

Economic TimesHigher rated companies have larger proportion of women on board, says Moody's

Companies based in advanced economies reflect a correlation between board gender diversity and credit ratings, but those in emerging markets do not, it said. This study considered 24 companies rated Aaa, 146 companies rated Aa, 728 companies rated A, 1,165 companies rated Baa, 582 companies rated Ba, 394 companies rated B, 90 companies rated Caa and nine companies rated Ca. Key Points

Economic TimesFewer jobs, lower salaries — how global headwinds, pandemic hiring swayed India’s job market

This year, IIM (Lucknow) & BITS Pilani asked its alumni to help with placements. These appeals come amid a global economic slowdown, indicating a difficult job market. Key Points

ThePrintWill the summer temperatures make them go higher this time? 5 stocks whose fortunes are dependent on how m

How monsoons pans out have a strong bearing on the overall economic numbers of the companies. However there are companies whose fortunes are linked with what happens before monsoons, that is summer season. Given the fact that we are about to see the start of the season, first forecasts from IMD about how the summer season is likely to pan out have started to come in and IMD is indicating that average temperatures may be higher this year.While the white good companies in general tend to see a bump up in their sales, but there are a select few whose large part of the sales and the bottomline contributions comes from air conditioners or air coolers part of the business. For these companies, two things are very important. First is what is the average length of the summer season and secondly what average temperature during those months. Last year these companies underperformed as the summer season got late. But as the street is always ahead in discounting what will happen in future, these stocks should be on the watch list as the run up in stock will happen much before you feel the summer heat. Key Points

Economic Times

Zepto, Blinkit to bulk up carts; no let up in Google vs Indian apps tussle

Quick-commerce platforms Blinkit and Zepto are set to expand beyond groceries, adding categories like fashion and electronics. This and more in todays ETtech Morning Dispatch. Key Points

Economic TimesIndia Inc’s diversity drive slow in including PwDs

Corporate India faces a long road ahead when it comes to incorporating people with disabilities (PwDs) into the workforce. According to SEBI-mandated Business Responsibility and Sustainability reports, over 87% of listed companies said their workplaces were accessible to PwDs, but only 0.6% of permanent workers employed were PwDs. Data compiled by primeinfobase.com showed that 38,989 of the 6.43 million permanent employees at these companies in 2022/2022-23 were PwDs. Key Points

Economic TimesIISc deep tech startups are pushing India into elite league. Baby firms with big ambitions

IISc Bengaluru’s deep tech incubator cell is going where few countries have gone before. AI, quantum computing, robotics, biotechnology to provide solutions in healthcare, edtech, space, agriculture, and more. Key Points

ThePrintLok Sabha polls: 100 central forces companies arrive in WB; 50 more next week

Around 100 CAPF companies arrived in West Bengal, with more expected ahead of Lok Sabha polls. Deployment started amid political row over law and order. | Kolkata News Key Points

Hindustan TimesIs the worst behind them? 5 stocks from electrical and mini white good space with upside potential of up t

On a day when the majority of the stocks are trading with a cut, one set of stocks which have been able to log in gains has been from a space which cannot be very clearly defined. The reason, what would you call a company which makes both, water geysers , and electrical wires, a white goods or electrical goods company.From the year 2015 to 2020, companies with strong brands in different sectors which were considered as commodity plays got re-rated by the street. The expansion in price earnings multiples of these companies led to big wealth creation.For the last more close to four years, with some more companies getting listed in the same sector and some headwinds emerging we saw these companies consolidating between a very broad range. Is the phase of valuation readjustment over, probably a time to get them on the watch list. Key Points

Economic Times

There is more to BFSI than just banks: Financial services stocks with “Buy” rating which may deliver 12-30

In the last few weeks, just because one bank has underperformed and was able to drag the market lower, that does not mean everything in one of the most important sectors of the economy, which is BFSI, is bad. This distinction needs to be made because in BFSI space every segment has a very different operating matrix and hence the growth path. So, while banks might be under pressure, AMCs have been doing well. Similarly, life insurers are under pressure but the general insurance companies have done well. So rather than a broad brush, have a look at companies individually for better decision-making. So rather than a broad brush, have a look at companies individually for better decision-making as analysts are bullish on many companies in the financial services space. Key Points

Economic TimesA play on broader economic recovery: 6 stocks from core industrial supplies segment with upside potential

While there are many ways to play the theme of industrial recovery, there is a set of companies, who don't come into headlines very often but a very high correlation between how the economy as whole is doing and a sector in particular. So while steel companies may come into news because of what happens to commodity prices and China, but the companies, which supply consumables like refractory material to them, don't come into the headlines. It is not only steel or metal, there are a host of sectors where there are niche players who supply critical input to another industry and their bottomline growth is linked to what is happening in the mother industry. Now there is little doubt that one after another things are turning better for many sectors, so some of these companies which supply industrial consumables are also coming into focus. Key Points

Economic TimesHDFC Bank, ICICI Bank are screaming buys at current prices: Nischal Maheshwari

Nischal Maheshwari, CEO of Centrum Broking, recommends green-oriented companies like Tata Power and NTPC in the metals and coal sectors. He suggests focusing on pharma companies like Sun Pharma and the hospital sector for investment opportunities. We are are strongly betting on goal-oriented companies. The power equipment companies have run much ahead of its course. We would recommend taking profits in BHEL kind of companies. Key Points

Economic TimesGovt departments split as trade talks with European pharma firms hit last lap, patent key issue

Last month, at least two meetings were held between representatives of India & European Free Trade Association. The FTA with the 4-nation bloc is likely to be finalised this month. Key Points

ThePrintBosses finally accept nobody wants to work on Fridays & companies are trying new tricks to bring workers b

Bosses are introducing new ways to combat the Friday lull, such as “Flow Fridays”, “Focus Fridays”, and “Flex Fridays”. Productivity on Fridays has become more important due to declining engagement rates after the pandemic. Managers are trying to boost morale and productivity by giving employees breaks and meeting-free Fridays. Key Points

Economic Times

Major companies join forces to combat AI-generated election interference

Major tech companies join forces to combat AI misuse in elections, focusing on deepfakes. Despite being symbolic, the pact aims to detect and label deceptive content. The voluntary agreement emphasizes rapid responses and transparency in company policies to safeguard democratic processes. Key Points

mintAnand Tandon on sectors to look at in present risk-return scene

GMR and Adani Group are potential choices for airport infrastructure. Rail companies' orders will provide significant upside. Capital goods and electronic manufacturing companies' earnings were disappointing due to low margins. RVNL is a well-managed company. Dixon is disappointing. I would like to flag that in most PSUs, the changes in the management are minimal, but the order books are definitely great but that does not necessarily translate into 800%, 1000% growth in terms of the stock price that we have seen in some of these stocks. Key Points

Economic TimesHeadcount at IT biggies falls for four quarters

The collective headcount of the top eight IT companies fell 17,534 in the quarter ended December 31 compared with the previous three months, according to data compiled by Xpheno, a specialist staffing firm. Compared with a year earlier, the staff count at these companies - Tata Consultancy Services, Infosys, Wipro, HCLTech, LTI Mindtree, L&T Technology Services, Tech Mahindra and Cognizant's India business - were down by 75,000, the sharpest fall in at least six years. Key Points

Economic TimesBenefiting from higher GDP growth: 5 logistics companies with upside potential of up to 45%

The whole logistics sector has seen a major shake-up in the last few years, right from tech aggregators who came into the scene with a promise to disrupt, challenges that Covid brought on the table to a phase where oil prices become a pain point for margins. After all the challenges, the sector has emerged stronger as some companies restructured their operations to stay profitable. There are many facts about the logistics industry which might surprise many. Just to mention a few, a metal major has such a large fleet of owned trucks that the unit itself can be listed as a separate company and probably would figure in the top 5 logistic companies. Last year at one point of time, the market cap of one single company was higher than the market cap of all the private sector companies put together and interestingly that company was in the red. Key Points

Economic TimesGovt departments split as trade talks with European pharma firms hit last lap, patent key issue

Last month, at least two meetings were held between representatives of India & European Free Trade Association. The FTA with the 4-nation bloc is likely to be finalised this month. Key Points

ThePrint

Old is gold, but new-age cos prefer younger CEOs

Deloitte India's recent decision to send 35 senior partners above the age of 55 has sparked debates about ageism in India. However, data indicates that below-40 executives often run the show at new-age companies and startups, with large and complex firms relying on battle-hardened corporate veterans who have negotiated multiple business cycles. In NSE-500 companies, a typical Indian CEO today is 57 years old, similar to data on C-suite occupancy for Fortune-500 firms. Key Points

Economic TimesFMCG majors slash prices, hike advertising spends to beat regional brands

Top FMCG majors, including Hindustan Unilever, Marico, and Adani Wilmar, are reducing product prices and increasing marketing investments to combat competition from regional brands. These companies have faced a decline in market share due to lower-priced products from local and unorganised players. By lowering prices and increasing pack weight, they are already witnessing sales growth and expect further gains in the coming months. Hindustan Unilever anticipates that pricing corrections and increased pack weight in detergent bars will help in the fight against local players. Additionally, companies like Marico and Adani Wilmar have seen improved volume growth and doubled sales in their branded segments. Key Points

Economic TimesOpportunity in headwinds with a long-term perspective? 5 agro-chemical stocks with upside potential of up

Three years back, the whole agro chemical sector got rerated and some of the Indian companies which are focussed on domestic markets getting their fair share of attention from the street. But then they faced sudden headwinds as the Chinese companies once again became over active. Some time headwinds which bring a phase of underperformance in stocks are opportunities to enter those sectors and stocks with a long term perspective, because on the macro front the sector has more plus than minus. If one looks at what management of these companies have stated in recent past is that some of these headwinds are due to inventory issues which are getting over. Is the worst of the issues behind the agro chemical companies? Key Points

Economic TimesIPO Calendar: 6 new issues, 10 listings to drive primary market action next week

Currently, there are 25 draft offer documents, filed by various companies, under process with the market regulator Sebi. Nearly 30 companies have already received a green signal from the regulator, aimed at raising over Rs 30,000 crore. Meanwhile, about 40 other companies have submitted their DRHPs for approval. Key Points

Economic TimesIndian companies can now list on international bourses in GIFT City

India Business News: Indian companies are now allowed to list directly on international exchanges in GIFT City, providing them access to a wider pool of investors. This move will boost foreign investment flows and broaden the investor base for Indian companies. Key Points

Times Of India

Big GIFT: Norms unveiled for direct global listing

India has allowed domestic companies to list their shares directly on global exchanges at Gujarat's GIFT City. The new regulatory framework provides easier access to foreign capital for entities in the sunrise and technology sectors. Key Points

Economic TimesAman Chowhan says market volatility due to profit booking; continues to like private banks

Aman Chowhan of continues to like private banks and has added non-fund-based financials like wealth management companies to the portfolio. The recent correction in the market is seen as profit booking after strong gains in the past months. Chowhan believes that the correction is more of a technical than a fundamental reason. In terms of sector allocation, the portfolio has increased exposure to non-funded financials and remains selective on large PSU banks. The fund manager is confident that FIIs will continue to invest in India due to the country's growth potential and lack of other investment opportunities. Key Points

Economic TimesFor taking advantage of auto and tyre sector: 2 stocks from an important part of their supply chain

Recently, a promoter of a tyre company in a lighter vein mentioned that one of the parts which ICE vehicles and Electric vehicles have in common is tyres. While it might appear to be an obvious statement , over the years, if one looks at the way tyre stocks have performed it has been much better than what it used to be, the cyclicality has gone away and there has been a re-rating. Now if tyre stocks are doing well then the companies which are supplying raw material to tyre companies are also witnessing tail winds. These are B2B players which are into manufacturing carbon black and because they are not consumer facing businesses, these companies don't come into the limelight even when they are doing well. Key Points

Economic TimesChakri Lokapriya on 4 cement and metal stocks to consider now

HDFC Bank's results reflect the transition the bank is going through, with the need to increase their share of loans with retail and SME. Loan growth for the bank is expected to pick up in the coming quarter. The valuations are all right, and earnings are slightly mixed. The IT sector is experiencing a pivot, with US interest rates set to fall, leading to the execution of pending order books. The financial services industry in the US will be the first to start executing orders. Key Points

Economic TimesIndia tech majors add $22 billion to market cap in just two days

India Business News: Shares of Indian software giants started the new year on a roaring note after higher-than-expected sales last quarter surprised investors and helped burnish the outlook for the sector. Find out how the IT giants added $22 billion to their market cap in just 2 days. Key Points

Times Of India

IT giants add $22 billion to market cap in just 2 days

Led by industry heavyweights TCS Infosys, the four key software companies, have added about $22 billion in market value in just two trading sessions since Thursday, when the Q3 earnings season kicked off. A potential revenue rebound and easing global macroeconomic worries have boosted sentiment. Key Points

Economic TimesKKR will deploy its next $10 billion in India faster than before, says founder Henry Kravis

Kravis spoke to Arijit Barman on a range of topics that included US jobs and capital markets and the impact on deal-making, exits, PE consolidation and where in India KKR, one of the world's biggest private equity firms, will make the next big investment. From cyber security to data centres and financial services and AI, the scope is broad. If India can be a low-cost and efficient producer and the infrastructure and red tape continue to get better, Kravis is confident the economy will attract more overseas investment. Key Points

Economic TimesHow much positivity in IT stocks is already priced in? Apurva Prasad answers

Apurva Prasad says s that the IT pack has experienced a positive movement in the last two months. However, he believes that a significant portion of the improved outlook is already priced into the market, with PE multiples increasing by 20-25%. Prasad emphasizes the importance of operational performance and highlights that many companies, including larger ones, have the potential for margin improvement. Key Points

Economic TimesPrice tags for most daily essentials will fall in next few months

These pricing actions are part of an all-out effort by the companies to improve volume sales which is crucial for the industry to expand their sales. The industry is expecting volumes to grow significantly from March-April onwards with lower and stable pricing, increased government spending ahead of general elections, and higher farming income aiding the recovery process. For FMCG, it is also to fight the increased competition from regional brands. Key Points

Economic TimesGoogle, Microsoft and Meta no longer top list of best places to work: Survey

Google’s ranking sank from No. 8 to No. 26, and Microsoft’s plummeted from No. 13 to No. 18 on Glassdoor’s list of the top 100 companies to work in 2024 | World News Key Points

Hindustan Times

Indians may get the highest pay hikes in Asia-Pacific region this year: Survey

In the Asia-Pacific region, Vietnam comes a far second, with a 6.7% median pay hike expected in 2024 (6.8% in 2023), followed by Indonesia with 6.5% (6.4% last year), according to the survey. Employees in Japan are likely to get the lowest increment at 2.5% (2.7% last year). Key Points

Economic TimesMedium to long term outlook for FMCG companies strong, margin expansion to continue: Kaustubh Pawaskar

Kaustubh Pawaskar says: “We should expect some improvement in demand from Q1 of FY2025 since inflation has also reduced and companies are passing on the benefit to the consumers in forms of price cuts and grammage increase. The benefits should start coming in the quarters ahead and if all goes well, monsoons turn out to be better, then it should help in revival in the rural demand.” Key Points

Economic TimesLooking for safety with a reasonable growth premium? 4 midcap stocks with right PEG ratio

One of the biggest challenges which companies face is the right allocation of capital. Over a long term it is the right allocation of capital which determines whether a business is able to create shareholder returns or not. This becomes even more pronounced in the case of the mid-cap companies where resources are even more limited. When looking at mid-cap companies, look carefully at PEG ratio which in the long-term indicates many things in a better manner than most other alternatives like PE which tend to create a mirage of value. Key Points

Economic TimesIndia orders new drug-making standards after overseas deaths

The Indian government has issued a notification requiring pharmaceutical companies to adhere to new manufacturing standards in response to concerns over the quality and safety of drugs. The move comes in the wake of overseas deaths linked to Indian-made drugs since 2022, prompting increased scrutiny of the $50 billion pharmaceutical industry. Key Points

Economic TimesPharma Sector: ICRA expects 9-11% growth in FY24 led by new launches, US rebound

Credit rating agency ICRA predicts that the revenues of 25 Indian pharmaceutical companies, which account for 60% of the Indian pharmaceutical industry's total revenues, will expand by 9-11% in FY24, compared to 10% in the previous year. The operating profit margin (OPM) is projected to improve to 22-23% in FY24, compared to 20.7% in FY2023. Key Points

Economic Times

Wait for results before getting into IT stocks; be more careful on power stocks: Deven Choksey

Deven Choksey says: “I would say that despite all the positives, if the valuations go up in a hurry, there may be a situation of some kind of a time correction if not price correction into the stocks at some point of time. One will have to wait and see. I am not bearish but at the same time I would like to be a little bit more careful in adding the power stock into the portfolio.” Key Points

Economic TimesRavi Dharamshi on how to approach PSU stocks and why he dumped IT

Ravi Dharamshi says: “IT companies have old legacy business, which is rolling off; and then there is this new business, which is digitisation, that is picking up. But the one that is rolling off is rolling off faster than the one that is growing. So at an aggregate level, these companies are not able to grow beyond 8, 10%, some gave guidance of 1 to 3%.” Key Points

Economic TimesWhat is going to be the big trend in 2024? Rajeev Mantri explains

Rajeev Mantri says: “what is very heartening is that the geographical spread of entrepreneurship in India has really widened and there is a certain breadth of sectors which have come to the fore. I do think that the startup India phenomenon is getting more momentum and the next one or two years are going to be really-really landmark years.” Key Points

Economic Timescompanies will ringfence talent through new approaches: Quess Corp executive chairman Ajit Issac

To further bolster the compensation game and retain top talent, firms will enhance their bespoke, holistic benefits offering models, to make the overall offering more lucrative. companies are offering employees an unlimited leave policy to prioritise wellbeing and manage time during childrens board exams. With medical inflation between 12% and 13%, companies are continuously looking to upgrade corporate health insurance. Key Points

Economic TimesSME IPO market witnesses a record run in 2023

Out of the 166 SME companies listed, 136 closed higher on debut and 24 companies recorded over 99.5% gains on listing day. Goyal Salt had the highest listing day gains at 258% followed by Sungarner Energies and Basilic Fly Studio with 216% and 193.4% gains, respectively. The most visible aspect of SME IPOs was the subscription rates, said FYERS. Fifty-one companies reported a subscription rate of over 100 times while 12 witnessed subscription rates more than 300 times. Key Points

Economic Times

Back in the limelight, will re-rating work this time? 4 power sector stocks with upside potential of up to

While the recent performance of stocks like REC, PFC and recently listed IRDEA has brought focus back to one segment of power companies. But the fact is that in the last few years, the sector has been going through a consolidation. Some of it was forced by the banks due to many companies going under the IBC and some due to the fact that any industry which has gone through a troubled phase of almost a decade, the players who are able to survive tend to get more attention because they have learnt the art of surviving a tough phase which is one most important feature for long term survival. Power sector stocks are now catching up with what the market has witnessed in the last few years. Key Points

Economic TimesYear-ender 2023: 86% mainboard IPOs, 82% SME issues delivered listing gains this year

While a large pool of investors focused mainly on listing gains, several IPOs have given better returns ranging from 50% to 140% after the initial phase of listing. About 42 companies continue to hold or deliver better returns than their initial gains. Key Points

Economic TimesBigger, Stronger, Better: Top companies of 2023 are batting in peak form

At the aggregate level, the incumbent cos show manageable debt and improving ability to service it, adequate equity and healthy top-line and bottomline growth. While oil and gas has retained its status as the biggest sector in the listing based on annual revenue, banking leads in net profit share aided by buoyancy in credit offtake and improving asset quality. Key Points

Economic TimesNiche technologies, smaller IT companies will make a big splash: Romal Shetty, Deloitte India

“Any company which has a very unique IP which is not easy to copy. That was one thing common to successful companies. The second one is being technology-enabled even in those days, when tech was not so big. Third is scalability. companies that followed these three principles, have been fairly successful.” Key Points

Economic Times