Rapid digital growth transforming payments bank segment: Airtel

Airtel payments Bank CEO Anubrata Biswas is optimistic that the payments bank momentum in India will yield strong growth opportunities in the coming... Key Points

The Tribune IndiaFintech is making global payments its business

Razorpay, Cashfree, PayGlocal, and new entrants rush for RBI's PA-CB licence to tap into lucrative B2B cross-border payments market. Fintechs eye big share of $250B SME exports, focusing on high margins and expanding services. Key Points

Economic TimesNow, pay using UPI to Nepalese merchants

Indian citizens can now conduct QR-code-based UPI transactions in Nepal as NPCI International payments Ltd (NIPL), the international arm of National... Key Points

The Tribune IndiaCertain payments to units in IFSC exempted from TDS

The Indian government has exempted specific payments made to units of 14 service sectors in the International Financial Services Centre (IFSC) from TDS (Tax Deducted at Source) provisions, effective April 1. This move aims to reduce the tax compliance burden and is applicable to sectors like FinTech, banking, fund management, insurance intermediary, and investment banking. Key Points

Economic TimesDo you have @Paytm UPI handle? RBI has a message for you

RBI had placed restrictions on Paytm payments Bank. The bank won't be able to accept more deposits into its accounts and wallets after March 15, 2024. Key Points

India Today

Paytm bank RBI Ban: Indian fintech is fast, furious — and fraudulent?

The Reserve Bank of India has taken regulatory action against Paytm and Visa Inc., and more nonbank intermediaries may be targeted. The growth of neo-banking in India has increased the risk of fraud. KYC regulations and digital payments face challenges, and nodal accounts are used for real-time processing. Key Points

Economic TimesPhonePe anticipates increased market share: CEO Sameer Nigam on RBI action against Paytm

PhonePe CEO Sameer Nigam expects to gain from potential decline in Paytm's user base. PhonePe witnessed an increase in user base due to regulatory challenges faced by Paytm payments Bank. PhonePe holds a 46% share in UPI volumes. Key Points

Economic TimesMoney laundering suspected: More payment banks under scanner

About 30,000 of these are with payments banks other than Paytm payments Bank and details have already been given to the Reserve Bank of India (RBI), which is looking into these and has sought further information, said people with knowledge of the matter. The banking regulator didnt respond to queries. Key Points

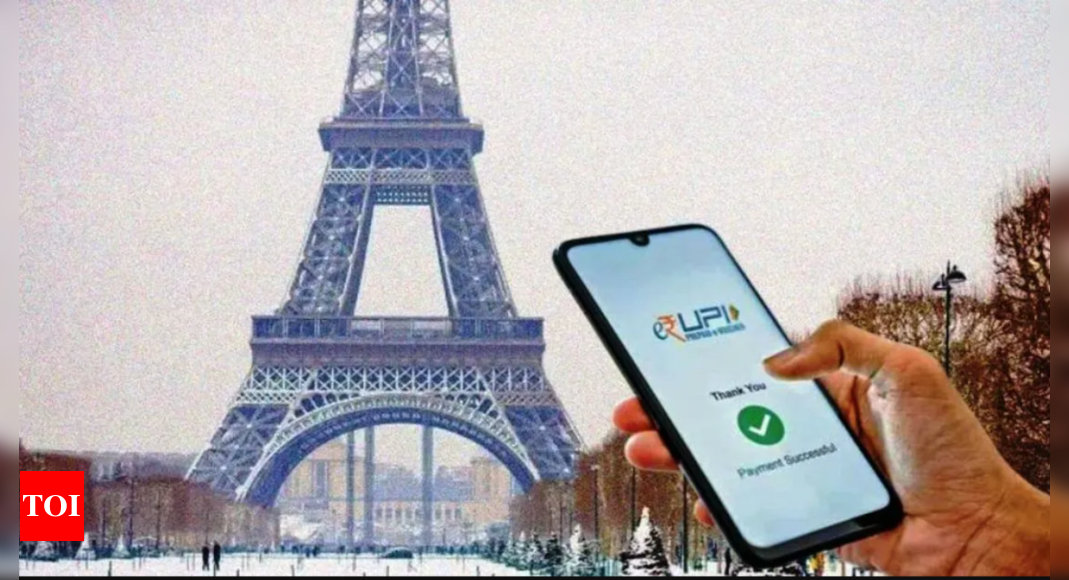

Economic TimesAfter France, UPI services now available in Sri Lanka and Mauritius

The introduction of UPI services in these countries will facilitate easier and faster digital transactions for Indian nationals traveling to Sri Lanka and Mauritius. Additionally, Mauritians visiting India will also be able to utilize UPI for their payments. Key Points

Business TodayTwo independent directors quit Paytm payments Bank board

Paytm founder Vijay Shekhar Sharma and PPBL managing director and chief, Surinder Chawla, are also members of the Noida-based payments bank board. PPBL faced regulatory issues after being barred by the RBI from accepting deposits or providing banking services after February 29. Key Points

Economic Times

India’s UPI launches in France, read PM Modi’s congratulatory message

India’s Unified payments Interface (UPI) service is now officially available at the iconic Eiffel Tower in Paris, France. Prime minister Narendra Modi has congratulated France for the formal launch of UPI at the Eiffel Tower. In a post shared on social media platform X, Modi said that the move is a wonderful example of encouraging digital payments and strengthening ties. Key Points

Times Of IndiaPaytm starts getting downgrades after RBI ban, lowest target price at Rs 500

RBI imposes restrictions on Paytm payments Bank, leading to downgrades by brokerages like Jefferies. Jefferies cuts target price to Rs 500 per share, citing reputational risks. Macquarie highlights serious implications of RBI ban on Paytm's ability to retain customers and sell payment and loan products. Paytm clarifies that user deposits are not impacted, but wallet and merchant payments business will be affected. Founder Jefferies cuts Ebitda estimates by 45% and expects delayed profitability. Key Points

Economic TimesGoogle Pay India signs MoU with NPCI International for global expansion of UPI

New Delhi [India], January 17 (ANI): Google India Digital Services (P) Limited and NPCI International payments Ltd (NIPL), a wholly-owned subsidiary of the National payments Corporation of India (NPCI), have signed a Memorandum of Understanding (MoU) to expand the transformative impact of UPI to countries beyond India. The MoU has three key objectives. First, it […] Key Points

ThePrintGoogle Pay signs pact with NPCI to expand UPI payments outside India

MoU will enable Indian travellers to make payments in other countries via Google Pay. Google India Digital Services and NPCI International payments Ltd (NIPL)... Key Points

The Tribune IndiaTata Pay bags payment aggregator licence; Binny Bansal’s new startup OppDoor

Happy 2024! Welcome to the first edition of ETtechs Top 5 in the new year. Tata groups digital payments business, Tata Payments, has secured a payment aggregator licence from the Reserve Bank of India (RBI). This and more in todays edition of our daily evening newsletter. Key Points

Economic Times/cloudfront-us-east-2.images.arcpublishing.com/reuters/LIWBAP6VNNODHHHWTVZDXACNCY.jpg)

payments regulator proposes cap on Mastercard, Visa cross-border fees

Britain's payments regulator on Wednesday provisionally proposed a cap on cross-border interchange fees charged by Mastercard (MA.N) and Visa (V.N) on transactions made between the UK and European single market. Key Points

ReutersRBI declares formation of repository for fintechs to expand digital payments

The Reserve Bank of India (RBI) has increased the limits on UPI payments to Rs 5 lakh for specific situations and announced the creation of a repository for fintechs. This move aims to expand digital payments and reduce reliance on physical cash or cheques. The limits for UPI transactions made to hospitals and educational institutes have been raised from ₹1 lakh to ₹5 lakh per transaction. Key Points

Economic TimesNo OTP authentication for UPI auto payments up to Rs 1 lakh for these three transactions

The Reserve Bank of India (RBI) has hiked the transaction limit for UPI auto payment limits requiring OTP -based authentication to Rs 1 lakh from Rs 15,000 currently. As per the announcement, new limit will apply on mutual fund subscriptions, insurance premium and credit card repayments. Read on to know the new rules. Key Points

Economic TimesNexi CEO: happy to help UniCredit on payments but contract is set

Nexi (NEXII.MI) is happy to work with UniCredit (CRDI.MI) to help one of its biggest clients achieve its ambitions in payments, but the contract between the two groups is "solid" and any change would have to benefit both, Nexi said on Thursday. Key Points

ReutersHow India's UPI is now travelling places, in charts

India has signed agreements with more than two dozen countries to expand UPI beyond its borders. The expansion will help Indians living abroad to send remittances home or for Indian travellers to transact with local merchants. Key Points

mint

Mahadev book app case: ED summons actor Shraddha Kapoor

The Enforcement Directorate has summoned Bollywood actor Shraddha Kapoor to appear before them in connection with their probe into the illegal online betting platform Mahadev Book app. The agency is investigating celebrities who endorsed the app on social media and received payments, which they consider to be proceeds of crime. Key Points

Economic TimesRBI announces slew of measures to drive growth of UPI-based payments

The RBI proposed to facilitate offline transactions using Near Field Communication (NFC) technology on UPI-Lite. This feature will not only enable retail digital payments in situations where internet and telecom connectivity is weak or not available, it will also ensure speed, with minimal transaction declines. Key Points

Economic TimesNow make conversational payments using UPI and AI: RBI

The Reserve Bank of India has announced the use of artificial intelligence for making UPI payments. The RBI has announced the use of conversational payments. NPCI will issue directions shortly. Key Points

Economic TimesProcessing over Rs 18,000 cr in payables, how Cashflo used AI in one of the most stressful, error-prone bu

India needs companies that can automate the accounts payable function of small businesses for seamless operations. Such players can also help resolve larger issues in supply chain financing. Key Points

Economic TimesIndia's Paytm says quarterly revenue rises 39% as loan demand soars

Indian digital payments firm Paytm (PAYT.NS) reported a 39% rise in quarterly revenue, helped by soaring demand for loans. Key Points

Reuters

Gupshup in talks to get its UPI app on feature phones

Indian messaging firm Gupshup is talking with several handset makers as it seeks to preload its app, GSPay, onto feature phones. The app, which uses SMS messaging to execute UPI payments without a data plan or internet connectivity, features several levels of security, with multiple levels of encryption and authentication, according to Gupshup. The company recently partnered with HMD, the company that now makes Nokia-branded phones. It also says it will work with other firms to introduce additional services. Key Points

Economic TimesWhy cash will become a commoner; and other top tech & startup stories this week

To be sure, cash will continue to play a big part in the Indian economy. But over the next five years, cash will no longer be king. It will have to take its place among commoners. Key Points

Economic TimesJet Airways CEO Sanjiv Kapoor quits

After the National Company Law Tribunal (NCLT) ruled the case in favour of JKC, it was given 180 days to make payments of Rs 180 crore to the erstwhile creditors of the airline and Rs 250 crore to former employees. While May 14 is the last date to make the payments, the consortium has made no payments so far. Key Points

Economic TimesNPCI chief says basic UPI services will remain free

The basic services of UPI will continue to remain free. Work is on with the government for incentives, he told reporters. But the value-added services of UPI, where the ecosystem needs some incentives to drive the adoption - whether it is mandate and credit - that's how the benefits will be accrued and the larger benefits for merchants and consumers would come from that. Key Points

Economic TimesPPI Wallet transactions of over ₹2,000 on UPI to attract 1.1% charge from April 1, 2023

Starting April 1, 2023, merchant transactions over ₹2,000 done through PPI wallets on UPI will attract an interchange charge of 1.1%. Key Points

The Hindu

Citi sees Paytm shares rising 82% as growth momentum sustains in Feb

Its payments consumer and merchant base offers a large addressable market, thereby providing a long runway for growth. We continue to work with our partners to remain focused on the quality of the book, the company said. Key Points

Economic TimesSBI happy to welcome merchants looking to shift from Paytm bank: Dinesh Khara

SBI is reaching out to merchants to support payment systems amid regulatory action on PayTM payments Bank. SBI Payments, a company supporting various payment solutions, is open to a one-time migration of accounts. RBI has ordered Paytm payments Bank to halt basic payment services due to rule violations. Despite minimal business ties, SBI is willing to help stabilize the system. Key Points

Economic TimesAfter series of ‘violations’, Paytm may lose payments Bank licence

Few months ago, the RBI had alerted the Directorate of Enforcement of about possible money laundering and know-your-customer (KYC) violations at Paytm. Now, Paytm might be staring at losing its payments bank licence. Key Points

Economic TimesPaytm Recap 2023: 912 Cr merchant transactions made in Q2FY24, Delhi makes most payments between 12-6 am

New Delhi [India], December 27 (ANI): One97 Communications Limited (OCL) that owns the brand Paytm, India’s leading payments and financial services company and the pioneer of QR, soundbox and mobile payments, today announced the release of Paytm’s 2023 Recap. The Recap showcases a year of leadership in payments and incredible user engagement on its app. […] Key Points

ThePrintUPI transactions up 60% in March to record 8.7 bn

Transactions on the Unified payments Interface (UPI) platform rose 60% year-on-year (y-o-y) in March to a record 8.7 billion, data from National payments Corporation of India (NPCI) showed. Key Points

Financialexpress

SBI partners with Paytm for its UPI business: Report

Last month, One 97 Communications (OCL) shifted its nodal accounts or escrow accounts to private-sector lender Axis Bank, the company said in a filing to the BSE. This would ensure that merchants who accept digital payments through Paytm can continue doing so even after the deadline ends on March 15. Key Points

Business Today