Don't paint all software companies with the same brush; 3 mid and 3 smallcap IT stocks operating in niche

It is not only mid-cap as a whole segment which has outperformed the other segments. Even in some sectors, while the large cap have not performed well, mid-cap stocks in the same space have done well. IT is one sector where the large caps have done nothing in the last two years, but selective stocks have been doing well. It is probably a time to take a look at each company separately rather than just looking at what stocks like TCS and Infy are doing and take a call on the overall sector. Key Points

Economic TimesLiquor barons raise a toast to 7% growth in June quarter

Demand increased for all key segments of whisky, rum, gin and vodka, especially in the premium category, industry executives said citing latest excise department data. Brandy was the only exception and grew just 1% as the segment sales are historically skewed towards winter months. They expect faster growth in the second half of the calendar that typically accounts for a larger share of liquor sales due to festivals and weddings. Key Points

Economic TimesNifty Auto index stocks: Festive season is a test for EV inflection point

In some segments like cars and two wheelers do have witnessing rising sales in festive season. But this time in case of even in these two segments, what would be more interesting to watch would be the fact how much sales the EV segment is able to get. If there is a sharp jump in EV numbers then it would mean that the final inflection point as far as the price is concerned will be higher than what has been estimated earlier. Which means early adoption. So when companies announce their sales numbers for the following months, October, November and December, it would throw a light on possible winners for next year. Key Points

Economic TimesCrisil upgrades Thomas Cook India’s credit rating

The travel service provider said its revenue increased 164% to ₹50.91 billion in fiscal 2023 from ₹19.31 billion the previous year owing to the strong resurgence in demand and robust recovery in all business segments Key Points

mintA play on economic growth and transformation: 7 auto stocks from different segments with upside potential

Unlike the US and some other western countries, where a separate transportation index is watched very closely, in India we don't have a very popular transportation index. The reason why transportation index numbers are extremely important is because there is enough historical evidence to show that auto industry numbers lead indicators of what is happening in the economy. If one looks at the history of the stock market, the rallies which are led by the transportation and auto sector are more durable rallies. Especially the ones which are led by large commercial vehicles. The reason, sales of LCV and certain other auto segments is an indication of the economic situation on the ground. Demand for large commercial vehicles would only increase when there is higher economic growth as more goods get moved from one place to another when the economy is doing well. Key Points

Economic Times

Is it time to sell a Trent and buy a VIP? Is it time to flip? Here’s what Sandip Sabharwal has to say

Sandip Sabharwal has been buying Bata shoes and stocks. He believes that the volume growth in footwear will bounce back. He also bought VIP stocks and thinks that the luxury segment will continue to grow. Sandip mentions that companies in the power supply chain like transformers, transmission, storage, and metering will perform well. Key Points

Economic TimesFinancial services stocks: Each one has a different operating matrix and phases of performance on the stre

While they all come under the broad umbrella of financial services, they are so diverse that each segment is an industry in itself which is governed by an operating matrix that is very different from another. For example, a Housing finance company can be happy with 10 percent net margins, but for an average asset management company ( AMC) the net margin would be more than 30 percent. The only common thing that binds the financial service sector is the GDP growth rate as the growth in all segments has a certain well-defined relationship with GDP growth. Key Points

Economic TimesKeysight Technologies beats quarterly profit estimates

Keysight Technologies (KEYS.N) beat market estimates for fourth-quarter profit on Monday, as the electronic equipment maker continued to benefit from steady demand in segments such aerospace and defense. Key Points

ReutersStock picks of the week: 5 stocks with consistent score improvement and upside potential of up to 37%

For the last three weeks, the stock market has witnessed correction in all segments of the market. Whether it is, large, mid or small cap market breadth in all segments remained weak in a number of trading sessions. In such times, if one is looking to buy stocks it would be better to look at stocks where some fundamentals developments have made analysts turn bullish on them. These selected stocks depict a strong upward trajectory in their overall average score which is based on five key pillars i.e. earnings, fundamentals, relative valuation, risk and price momentum. This implies that there has been a significant improvement in their market outlook in the given time frame Key Points

Economic TimesWeaving profitability in new global order; 4 stocks from textile sector with upside potential of up to 35%

Different segments of the textile sector came into focus post covid, partially due to China Plus one narrative. Secondly due to the fact that the government has been focusing on manufacturing. would they be able to take the full advantage of the PLI scheme and stay on the path of consistent and above average profitability or it will be just another phase? analysts are more positive than they have been in the past. This list is drawn from Stock Reports Plus, powered by Refinitiv, with over 4,000 listed stocks along with detailed company analysis focusing on five key components - earnings, fundamentals, relative valuation, risk and price momentum. Key Points

Economic Times

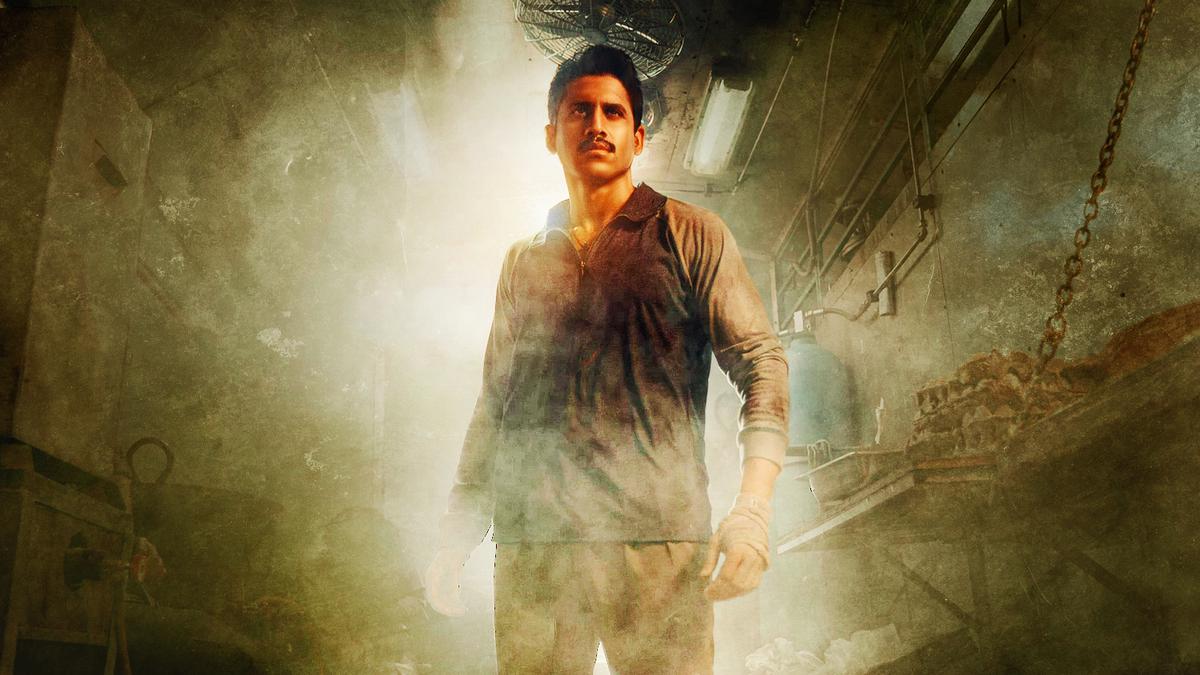

‘Custody’ movie review: Venkat Prabhu’s mix of conflict and humour works for this Naga Chaitanya, Arvind Swami actioner

The Telugu-Tamil bilingual “Custody” starring Naga Chaitanya, Arvind Swami and Krithi Shetty also has several trademark Venkat Prabhu flourishes such as peppering the narrative with humour without diluting the tense moments. These segments work to the advantage of this action entertainer and help overlook some of the rough edges. Key Points

The HinduReliance net debt continues to rise from YoY perspective despite capex declining sharply QoQ: Probal Sen

Reliance Q3 numbers were fairly strong with performance in several segments offsetting weakness in the gas exploration and O2C segments. Net debt continues to rise despite declining capex. Retail showed a 23% YoY growth in revenue and a 30% improvement in EBITDA, but return ratios remain below 10% due to increased capital allocation. Optimism remains for Jio's ARPUs with traction expected from enterprise and fiber to home business, 5G investments, and tariff monetization. Stock price outlook is neutral with a fair price of Rs 2600-2700. Key Points

Economic TimesBJP's 'GYAN' formula: Focus on 2024 polls, Union budget

The BJP has created a 'GYAN' formula for 2024, targeting four segments: Garib (poor), Yuva (youth), Annadata (farmers), and Nari (women). The party plans to focus on these segments in its outreach and the upcoming Union budget. Prime Minister Narendra Modi has emphasized the importance of uplifting these castes for the country's progress. The BJP is working on campaigns for each segment, using English slogans to reach millennials. Key Points

Economic TimesFedbank Financial offers exposure to the fast growing MSME lending business

True North Fund, a private equity firm and the selling investor, will reduce its stake to 14.4% from 25.4%. The lender focuses on rapidly growing segments of micro, small and medium enterprises (MSME), self employed individuals and gold loans. Key Points

Economic TimesETMarkets Fund Manager Talk: Limited inflows into midcap scheme via SIPs, deferred smallcap fund launch: W

Whiteoak Capital limits midcap scheme inflows and defers smallcap fund launch. Rally driven by earnings resurgence. SEBI restricts overseas ETF inflows. India's market outlook remains strong with potential for alpha generation. Pant says: From a prudent risk management perspective, we continue to stay fully invested at all times with a bottom-up approach to investing in great businesses at attractive valuations. Key Points

Economic Times

10 stocks from different sub-segments of financial service space with more than 25% upside potential

There have not been many instances where one would have seen PSU banks strongly out performing the private banks. But we have seen a divergence in recent times. This probably is a reflection that finally the street has realized that it is wrong to paint all the companies in the banking sector with the same brush. It is even more true for the other parts of the financial service sector with the same brush. While they come under the umbrella of the BFSI, the operating matrix of each segment of financial service is very different and hence it is extremely important to have a look at segments with different lenses. The only common thing which binds the financial service sector is the GDP growth rate as the growth in all segments have a certain well defined relationship with growth in GDP. Key Points

Economic TimesV-Guard posts Q3 profit beat on sturdy demand across segments

V-Guard Industries, an electronic products maker, reported Q3 profit of 582.4 million rupees ($7 million), exceeding estimates. The company experience Key Points

Times Of IndiaFor calculated risk takers: 4 smallcap stocks with upside potential of up to 32%

It was the second time in the last ten days that banks are leading to decline in the market and the midcap index is trading with cuts which were greater than broader market indices. Yesterday should serve as a reminder to all those who have been buying stocks in the last few weeks without even bothering to look both at fundamentals and valuations. For all those who are looking at taking fresh exposure in small and mid-cap segments it would be better that rather than doing post facto analysis they should do more homework by looking at some fundamental ratios and business of the company. Despite doing all this, one should be ready to see a draw down as risk cannot be eliminated but only managed. Key Points

Economic TimesJack Henry & Associates revenue rises on steady demand for fintech products

Fintech firm Jack Henry & Associates (JKHY.O) reported a rise in its first-quarter revenue on Tuesday, helped by steady growth in its processing as well as services and support segments. Key Points

ReutersIndia's Alembic Pharma Q2 profit roughly in-line with estimates

India's Alembic Pharmaceuticals (ALEM.NS) on Tuesday reported second-quarter profit roughly in line with estimates, as higher sales in its domestic and overseas markets offset a jump in expenses. Key Points

Reuters

Nifty healthcare index stocks; Staying bullish on select pharma and hospitals

While they clubbed together, the operating matrix of a pharma company making drugs and hospital and a diagnostic company are very different. We take a look at what analysts are saying about different stocks from each of these segments. Stock Reports Plus, powered by Refinitiv, is a comprehensive research report that evaluates five key components of 4,000+ listed stocks - earnings, fundamentals, relative valuation, risk and price momentum to generate standardized scores. Key Points

Economic TimesNifty Auto index stocks: Selectively not secularly bullish

As the headwind for the auto sector starts to slow and the nifty auto index continues to outperform some of the other sectoral indices, we take a look at what analysts' views are on segments and sub-segments of the auto industry. Stock Reports Plus, powered by Refinitiv, is a comprehensive research report that evaluates five key components of 4,000+ listed stocks - earnings, fundamentals, relative valuation, risk and price momentum to generate standardized scores. Key Points

Economic TimesAfter a weak June quarter, recovery to be gradual for SRF

Since its financial results were announced, the stock fell 2%, contributing to cumulative decline of 5.5% so far in 2023. Key Points

mintNifty Auto index stocks: Transformation is at the doorstep, making analysts selective

As the headwind for the auto sector starts to slow and the nifty auto index continues to outperform some of the other sectoral indices, we take a look at what analysts' views are on segments and sub-segments of the auto industry. Stock Reports Plus, powered by Refinitiv, is a comprehensive research report that evaluates five key components of 4,000+ listed stocks - earnings, fundamentals, relative valuation, risk and price momentum to generate standardized scores. Key Points

Economic TimesCongress crosses 113-seat majority mark required to form government in Karnataka

On the other hand, the BJP won 55 seats and was ahead in 9 segments. The JD(S) emerged victorious in 18 seats and was leading in two constituencies. Two independents, one candidate each from 'Kalyana Rajya Pragathi Paksha' and 'Sarvodaya Karnataka Paksha' won. Key Points

Economic Times

Hotel companies go big on leisure and pilgrim towns as travel booms

The share of hotel rooms in the tier-II and tier-III cities increased to 38% of the total inventory at the end of 2022 from 33% four years ago according to a recent HVS-Anarock report. The share of hotel rooms in metros reduced to 19% from 30% during the period. Cities such as Agra, Haridwar, Manali, McLeod Ganj, Kasauli, Katra, Mahabaleshwar, and Vrindavan reported the opening of new hotels in the mid-market and upscale segments. Key Points

Economic TimesRBI's Repo-Rate Pause May Not Boost Affordable Housing Just Yet

Home sales rose 14% over a year earlier to 1.13 lakh in the three months ended March. Key Points

BQ Prime