71% of intraday traders incur losses, finds SEBI report. Impact higher among young, small traders

Number of intraday traders rose 4.6 times from FY19 to FY23, the report says. Though loss-makers increased, average loss fell drastically to Rs 5,371 in FY23 from Rs 20,701 in FY19. Key Points

ThePrintIndia-Maldives row: EaseMyTrip offers discounts on NATIONFIRST and BHARATFIRST codes

The discount came amid the row over Maldives leaders' derogatory posts on Prime Minister Narendra Modi last week. Earlier, Nishant Pitti, had announced the suspension of all Maldives flight bookings following the controversy. Meanwhile, traders' body CAIT has also called upon domestic traders and exporters to refrain from conducting business dealings with the island nation. Key Points

Economic TimesMore than 55% F&O traders buying more to average out losses: Study

Recently, the Securities and Exchange Board of India (SEBI) issued a report, stating that 9 out of 10 individual traders in the equity F&O segment incurred an average loss of Rs 1.1 lakh during FY22, with most of them operating in the options segment. Key Points

Economic TimesDesperate retail investors drive India's options craze

The Securities and Exchange Board of Indias crackdown on social-media influencers peddling advice is a losing battle. Although nine out of 10 individual traders are losing money, retail investors cant get enough of derivatives. A smartphone-led gamification of investing is complete. Key Points

Economic Timestraders Union Reveals the Best High Leverage Forex Brokers for 2023

While high leverage magnifies profits, it also amplifies losses. Trading discipline, continuous learning, and a meticulous choice of broker are the stepping stones to navigating the high-stakes world of Forex trading in 2023. Key Points

mint

traders Union Highlights Leading Forex Funded Accounts

TU analysts point out that traders may need to adapt to the trading platforms specific to each prop firm, potentially facing a steep learning curve. Moreover, managing losses within company parameters can prove testing. Key Points

mintWhen Roman merchants and soldiers came to Madurai to trade in pepper

Just a furlong away from where Vaigai, Marudhanadhi and Manjalar met at Kunnuvarankottai was built a toll gate ‘chunga chavadi. During the monsoon, the frothing rivers brought rich alluvial soil from their sources up in the Western Ghats. This fertile region had a rich vegetation of coconut groves and traders would rest in the shade after paying the six per cent due to the kings. They would have to shout to be heard above the roaring waters, as they met old friends and made new ones, some who were known as ‘yavanas’ by the local traders Key Points

The HinduGovt to announce national retail trade policy, accident insurance scheme for GST-registered traders soon

The government is likely to announce a national retail trade policy and an accident insurance scheme for GST-registered domestic traders soon, reported PTI, citing an official. The policy is aimed at providing better infrastructure and more credit to the traders. Key Points

Economic TimesDouble whammy! How tough is it to make money via options trading now?

His suggestion for stock option traders is to square off positions at least 2 days before the expiry in case of in the money (ITM) option. If you are deep in the money, then you should look for liquidity. For example, if the intrinsic value is Rs 20 and if you are getting a buyer at Rs 10-12, then you must exit. Don't wait for the last day as the liquidity will dry up, Sriwastava says. Key Points

Economic TimesGovernment to bring retail trade policy to promote ease of doing biz for traders

The Department is also in the process of formulating an insurance scheme for all the retail traders. The accident insurance scheme would particularly help small traders of the country. Key Points

Economic Times

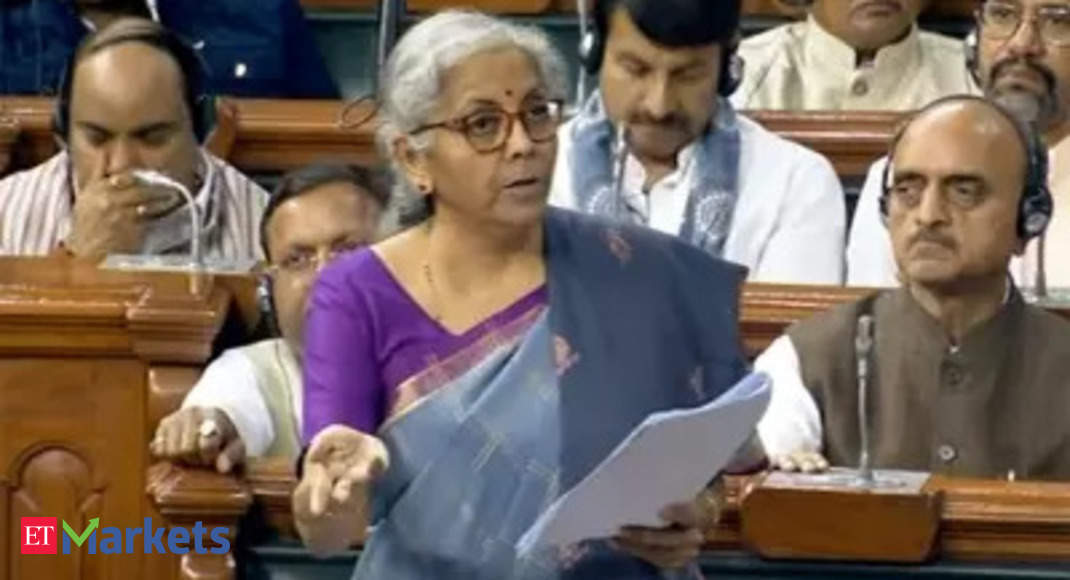

ETMarkets webinar: How to crack the code to profitable trades

ETMarkets is hosting a day-long webinar on June 3 with leading women traders to help traders navigate the market charts and develop effective risk management techniques. The event features sessions on the identification of multibaggers, momentum-based trading, basics of technical analysis, risk management, and different trading strategies. The webinar aims to help participants build a solid foundation in technical analysis, identify market trends, optimize entry and exit points, and make well-informed decisions. Nothing complex but effective. Key Points

Economic TimesIndia-Maldives diplomatic row: CAIT asks traders to refrain from dealing with island nation

The Confederation of All India traders (CAIT) has called on domestic traders and exporters to refrain from conducting business dealings with the Maldives amid the India-Maldives diplomatic row. CAIT Secretary General Praveen Khandelwal emphasized the need for mutual respect in diplomatic discourse and condemned any form of disrespect towards friendly nations' leaders. Key Points

Economic TimesDollar steady before Fed, euro slips on ECB cut comments

By Samuel Indyk and Ankur Banerjee LONDON (Reuters) -The dollar was steady on Monday as investors took stock of U.S. economic data ahead of the Federal Reserve policy meeting this week, while the euro Key Points

ThePrintG7 eases a facet of India diamond trade

The communication is a breakthrough for domestic diamantaires as G7's sanctions on Russian stones have been a setback for the nearly 1.5 million-strong Surat diamond industry, which is also struggling with demand and global economic slowdowns. Key Points

Economic TimesFact and figures investors and traders should look at before trading in IDFC Bank

In the last four years, only once has the stock of IDFC bank seen an up move of more than 5 percent in the first trading session after its quarterly results. That was when its Q1 of FY 23 results were announced. So all the traders who have bought call and put options have low probability of making those returns which they expect if there is sharp movement in the stock price post result. Whereas within one week of its quarterly results, the stock has seen movement in both directions which would have given option traders returns. So check some facts and figures, before making a decision to take a trade or invest on the day of result. Key Points

Economic Times

Nifty short-term trend still bullish; buy Jubilant FoodWorks, TechM, SBI Life to pocket gains

Nifty 50's short-term trend is still bullish, despite recent non-directional movement. 18,300 is a key support zone to watch for traders. Key Points

FinancialexpressScanner on private wheat purchases at Uttar Pradesh's Lalitpur

The clearance currently is required only for Lalitpur, where procurement was among the lowest in the state this season, but traders fear it could be extended to other districts as well if the overall numbers remained low. However, the Lalitpur district collector said the administration issued the April 12 order after it found out that private traders were buying wheat at below minimum support price (MSP). After verification of their documents, we will allow them to use railway rakes, Aalok Singh told ET. Key Points

Economic TimesF&O Strategy: Buy call on Kotak Mahindra Bank

We advise traders to buy plain vanilla call option on Kotak Mahindra Bank. Go long on 1760-call that closed with a premium of ₹24.65 last week Key Points

The Hindu93% retail traders lost money in F&O in 3 years: Sebi study

When it comes to equity derivatives trading, retail investors are on the back foot, as 93 per cent of them incurred losses with average loss of around Rs 2 lakh per trader during the last three financial years (FY 22 to FY 24), according to a new study conducted by the Securities and Exchange Board of India (SEBI). There are over one crore individual (Futures & Options) traders. Despite consecutive years of losses, more than 75 per cent, of lossmaking traders continued trading in F&O. Key Points

The TribuneCorrections are short term, focus on fundamental tailwinds: Banking stocks that may deliver more than 20%

Why should the decision which traders take, should not be copied by investors? Simple, traders are looking to generate income from short term movement in stocks, whereas investors focus has to be generating wealth from long term trend in growth of business. But the fact is that short term narratives which are essentially governed by technical factors, tend to affect a lot of investors also and that is what leads to decisions which should have been avoided. In the last three weeks, not even one sector has been spared by bears, they were seen across the street. So, while traders should bother about the fact that what has happened to bank stocks in the short term, investors should focus on whether the health of the banks both in terms of NPA’s and credit growth has been better or not. If that answer is yes, which at this point of time it is then what is happening to bank nifty should not bother an investor. Key Points

Economic Times

Indian state banks to snap two-month streak of selling govt debt: Traders

These banks, typically the biggest buyers of government debt, have sold bonds worth Rs 14,380 crore ($1.73 billion) on a net basis so far in December, following sales of Rs 8,840 crore in November, clearing house data showed. Key Points

Economic TimesOption traders sound alarm bells over sizzling Indian stock market rally

Proprietary traders have boosted net short positions in index calls, while trimming their net shorts in index-based puts, according to data compiled by Bloomberg. Prop traders — who take on market exposure for themselves rather than their clients — account for the largest single share of the total derivatives volume in India, so monitoring their positioning comes with extra significance. Key Points

Economic TimesVocal for local cheer amplifies: China foresees Rs 1 lakh crore Diwali trade loss

The call for 'Vocal for Local' reverberates, with consumers showcasing a strong preference for Made in India products. China is poised to lose around Rs 1 lakh crore in business related to Diwali festival items, as per an ANI report. Key Points

Economic TimesGamification of market? Derivatives to cash volumes ratio highest in India

Change in contract structure, leverage combined with the ease of onboarding and interface of the new generation trading apps has triggered gamification of this market. As a result, the number of active derivatives traders increased eightfold from less than half a million in 2019 to 4 million. This, in conjunction with sachetization, has attracted a younger demographic as well as clients from Tier II and III cities, the study said. Key Points

Economic TimesIndian rupee strengthens on dollar weakness, likely RBI intervention

The Indian rupee strengthened against the U.S. dollar in the final minutes of trade on Thursday as the dollar weakened, and traders cited likely dollar sales by the Reserve Bank of India. Key Points

Reuters

Indian rupee marks weekly gains on FII inflows; traders might see profit-booking at 83 level

The Indian rupee recorded its first weekly gain in three weeks due to rallies in domestic equities and foreign fund inflows. The rupee's strength is expected to be supported by month-end dollar inflows, central bank intervention, and lower crude oil prices. Key Points

FinancialexpressOil flips to a loss as traders weigh US economy against supply

Oil swung to a loss as traders weighed worse-than-expected US economic data against an improving inflation outlook and supply constraints..West Texas Intermediate slumped below $72 a barrel, after rising as much as 1.3% in earlier trading Key Points

mintDollar bobs near 2-month low ahead of pivotal US jobs data

By Amanda Cooper LONDON (Reuters) - The dollar seesawed around two-month lows on Thursday, as traders weighed up how pivotal U.S. jobs data coming out on a stock trading holiday might impact Federal Key Points

ThePrintWorld stocks dither, bonds steady as recession worries weigh

By Naomi Rovnick and Kevin Buckland LONDON/TOKYO (Reuters) -Global stocks drifted on Thursday and U.S. Treasury yields hovered near multi-month lows as traders awaited crucial U.S. jobs data that may Key Points

ThePrintAEL pips RIL to become top traded stock on NSE

AEL has clocked a trading volume of ₹46,832.5 crore in the month through 27 February, accounting for a whopping 5% of the overall exchange turnover of ₹9.36 trillion over the same period. Key Points

mint

7 of 10 intra-day equity traders lost money in FY 2022-23: Sebi study

A study by market regulator Sebi showed that 7 out of 10 individual intraday traders in the equity cash segment made losses in the financial year 2022-23.... Key Points

The Tribune IndiaTime to be contrarian? These 6 bank stocks can give over 18% returns

While the bank nifty might be facing pressure in today’s trading session, it is because of the three private banks with high weightage in the indices witnessing selling pressure.For contrarian and short term traders there might be an opportunity given the fact that it has been witnessed that such moves are followed by short covering sooner or later. But again this probably is trade for high risk traders or investors who have the ability to take a stand against market narrative. Check out Stock Reports Plus, powered by Refinitiv, for price targets of over 4,000 listed stocks along with detailed company analysis focusing on five key components - earnings, fundamentals, relative valuation, risk and price momentum to generate standardized scores. SR+ Reports is a complimentary offering to ETPrime members. Key Points

Economic TimesIndia's central bank likely sold US dollars to limit rupee's losses

MUMBAI (Reuters) - The Reserve Bank of India likely sold U.S. dollars on Monday to curb losses in the rupee, as the currency opened trading near its lifetime low, four traders told Reuters. The rupee Key Points

ThePrintRetail traders cash out as market rallies on bets of end to rate hikes

U.S. retail traders rushed to lock in gains from a share rally sparked by signs of cooling inflation, looking to recoup losses in their portfolios from a brutal 2022 due to rising borrowing costs. Key Points

ReutersRupee rises 10 paise to 81.96 against U.S. dollar in early trade

The Rupee gained 10 paise to 81.96 against the U.S. dollar in early trade on May 10 tracking the weakness of the American currency in the overseas market. Key Points

The Hindu

Finance Ministry clarifies on confusion over STT hike on selling options

Under the new rules, option traders will have to pay Rs 6,200 for every Rs 1 crore worth of turnover as against Rs 5,000 that is being paid currently. This translates into a hike of around 25%. Key Points

Economic TimesLearn with ETMarkets: Navigating MCX gold and silver contracts through technical indicators

Mastering MCX Gold and Silver contracts involves a strategic blend of technical indicators. The Moving Average EMA21 strategy, complemented by risk management techniques using the EMA8, provides a structured approach for both long and short positions. Incorporating the RSI for confirmation adds an extra layer of analysis enhancing traders' ability to identify trends and manage risk effectively in the dynamic precious metals market. Key Points

Economic TimesDollar steady ahead of Powell speech; Ueda aims to calm market nerves

By Ankur Banerjee SINGAPORE (Reuters) - The U.S. dollar was calm on Friday as traders braced for comments from Federal Reserve Chair Jerome Powell, while Bank of Japan (BOJ) Governor Kazuo Ueda aimed Key Points

ThePrintGold directionless ahead of US central bank decision

By Harshit Verma (Reuters) - Gold prices were in a tight range on Tuesday as traders awaited the U.S. central bank's decision on key policy rates and remarks from Chair Jerome Powell. Spot gold held Key Points

ThePrintRupee edges lower, but likely RBI hand limits decline

The Indian rupee ended weaker on Tuesday, after having held in a tight range for most of the session as the U.S. dollar's strength was offset, traders said, by the central bank selling the greenback to prevent the local unit from sliding further. Key Points

Reuters

Markets maintain positive trend for six weeks, 4% away from record-high; global cues, earnings to drive markets

Traders should dips to add quality stocks to their portfolio as Nifty 50 inches toward its record high. The index may test 18,700 levels. Key Points

FinancialexpressNifty seen consolidating, go easy on longs: Analysts

Chart patterns suggest the 10-20 day exponential moving average (EMA) zone of 21,580-21,630 will act as a strong support going forward. Until spot Nifty holds 21,580, we may witness the continuation of the current momentum up to levels of 22,100-22,150. Key Points

Economic TimesNever underestimate the power of simplicity! Especially in stock markets

ETMarkets is hosting a day-long webinar on June 3 with leading women traders to help traders navigate the market charts and develop effective risk management techniques. The event features sessions on the identification of multibaggers, momentum-based trading, basics of technical analysis, risk management, and different trading strategies. The webinar aims to help participants build a solid foundation in technical analysis, identify market trends, optimize entry and exit points, and make well-informed decisions. Nothing complex but effective. Key Points

Economic TimesMind Over Money: Alok Jain with nearly 3 decades of experience highlights 4 rules for every trader to mana

The key learning from the thousands of customers with whom I interacted with was that without a system, nobody can really make money in the long term. It is essential to have a framework for investing. Key Points

Economic TimesDollar slips on profit taking but upbeat outlook remains

By Saqib Iqbal Ahmed NEW YORK (Reuters) - The dollar slipped broadly on Friday as traders booked profits after recent gains but the U.S. currency remained well-placed for further advances, supported Key Points

ThePrintCurrency market calm before Powell speech, bitcoin picks up again

By Brigid Riley TOKYO (Reuters) -The U.S. dollar was largely steady on Wednesday, as traders avoided making big bets ahead of congressional testimony from Federal Reserve Chair Jerome Powell, as well Key Points

ThePrintGoing bananas: Prices rise to ₹30/kg from ₹18-20 in October

Banana inflation increased to 16.5% in November from 2.2% four months ago, according to consumer inflation data released last month. Retail prices have been hovering around ₹30 per kg now, up from₹ 18-20 in October, said traders. Key Points

Economic TimesRupee falls to 83.2850/USD, lowest in one year

But likely intervention from the Reserve Bank of India (RBI) capped further losses, traders said. The RBI likely sold U.S. dollars near 83.28 levels but the intervention was not aggressive, a foreign exchange trader at a private bank said. Key Points

Economic TimesRupee gains 6 paise to close at 82.75 against US dollar as crude oil weakens

Mumbai, Aug 7 (PTI) The rupee gained 6 paise to close at 82.75 against the US dollar on Monday, tracking positive domestic equities and lower crude oil prices. However, sustained foreign fund outflows and a stronger American currency in the overseas market dented investor sentiments, forex traders said. At the interbank foreign exchange market, the […] Key Points

ThePrintNifty needs to cross its peak to gain momentum: Analysts

Nifty had a strong 800-point rally in the last eight trading sessions, making an all-time high of 19,523. In the shorter time frame, momentum indicators show overbought signs, and FII index long positions have also reached 73%. Key Points

Economic Times