Central bankers' models need to increase emphasis on supply side: Shaktikanta Das

Macroeconomic models used by central banks so far have mainly focused on the demand side of the economy,'' Governor Shaktikanta Das told the 59th South East Asian Central Banks Governors' Conference held in Mumbai. Enough emphasis was not given on supply side factors. A better understanding of the supply side of the economy has become very important for conducting monetary policy more effectively. Key Points

Economic TimesDigitalisation helps improve monetary policy transmission: RBI

If digitalisation were to lead to a decline in resistance to price change by 10%, say, due to the rising online presence of retail stores and dynamic pricing algorithm, inflation fall could be higher at 35 bps without impacting the output in the economy. If the price elasticity of demand falls, inflation could drop by 30 bps (5 bps more than its baseline level), the study explains. Key Points

Economic TimesWith crises behind, will RBI dust off the liquidity framework?

Since the last MPC meeting in February, global financial markets have come full circle. Traders' bets have swung like a pendulum - from monetary easing to overcome an economic recession, to tightening to fight against inflation, and finally to easing for the sake of financial stability. All of that occurred in a matter of four months. Key Points

Economic TimesWar against inflation not yet won, says monetary Policy Committee member

A member of India’s monetary Policy Committee (MPC), Jayanth R. Varma, has said that it would be premature to declare an end to the tightening cycle and the war against inflation has not yet been won. Varma expressed reservations about the second resolution, stating that he could not put his name to a stance that he did not understand. He emphasized the need for heightened vigilance in the face of fresh risks such as an output cut by OPEC+ and monsoon-related issues. Varma also highlighted that a deficient monsoon could create inflationary pressures that would require counteracting with monetary policy measures Key Points

The HinduRupee rises 3 paise against US dollar

Mumbai, Jun 6 (PTI) The rupee consolidated in a narrow range to settle 3 paise higher at 82.60 against the US dollar on Tuesday amid a muted trend in domestic equities and fresh foreign fund inflows. The rupee is trading in a narrow range as market participants are vigilant ahead of the RBI’s monetary policy […] Key Points

ThePrint

Ground realities to guide rate action in June, inflation may have eased further in May: RBI Governor

Reserve Bank of India (RBI) governor Shaktikanta Das on Wednesday said the monetary policy committee (MPC) would be guided by “whats happening on the ground” on the issue of whether to take a pause again or not in its next meeting in June, even as he expected retail inflation to ease further in May from Aprils 18-month low of 4.7%. Key Points

Economic TimesGold holds tight range as traders await US data for more Fed cues

By Brijesh Patel (Reuters) - Gold prices were stuck in a narrow trading range on Tuesday as investors awaited more U.S. economic data this week that could shed light on the Federal Reserve's monetary Key Points

ThePrintWall Street subdued, gold slides ahead of CPI, Fed

By Stephen Culp NEW YORK (Reuters) -U.S. stocks were muted and gold slid on Wednesday, as investors bided their time ahead of crucial inflation data and the U.S. Federal Reserve's monetary policy Key Points

ThePrintRBI Governor to announce monetary Policy decision today

New Delhi [India], August 10 (ANI): The Reserve Bank of India (RBI) is poised to unveil its bi-monthly monetary policy for FY24 on Thursday. RBI Governor Shaktikanta Das is scheduled to make the official announcement of the MPC’s decision on Thursday, August 10, at 10:00 am. Show Full Article monetary Policy Committee (MPC) meeting which […] Key Points

ThePrintRBI appoints Muneesh Kapur as new executive director

Mumbai (Maharashtra) [India], October 4 (ANI): The Reserve Bank of India (RBI) appointed Muneesh Kapur as the new Executive Director, effective from October 3 (Tuesday). Prior to being promoted as executive director, Kapur was adviser-in-charge, of the monetary Policy Department and Secretary to the monetary Policy Committee. Show Full Article Over a span of nearly […] Key Points

ThePrint

Likely impact of food price shock on overall inflation prompted RBI to keep benchmark rates unchanged: MPC minutes

The Reserve Bank at its last bi-monthly monetary policy committee (MPC) meeting on August 10 decided to keep the benchmark interest rate (repo rate) unchanged at 6.5 per cent citing inflationary concerns. Key Points

Business TodayIndian shares set for muted open as US jobs data fuels rate concerns

Indian shares are set for a subdued start on Friday, tracking weakness in global peers, after data indicating strength in the U.S. labour market fuelled concerns of further monetary policy tightening. Key Points

ReutersMPC Minutes: War against inflation not yet won, premature to declare end to tightening cycle, says Jayanth

Two inflationary risks have come to the fore since the February meeting. The first risk emanates from the announcement of an output cut by OPEC+ during the weekend just before the MPC meeting. The second risk relates to the monsoon, said Jayanth Varma. Key Points

Economic Timesmonetary policy tight enough to restrict food inflation spread: MPC member Jayanth Varma

Jayanth Varma, an external member of the monetary Policy Committee (MPC), believes that the current phase of high inflation in India will be limited to a few months as monetary policy is tight enough to prevent food price shocks from causing broader price pressures. However, he also highlights the risk of slower global growth impacting India's economy. Key Points

Economic TimesRBI monetary policy: The liquidity lever may prove to be better price tamer

Whenever monetary authorities wanted to influence price levels for goods and services, they resorted to the popular tool — interest rates that make money more expensive or affordable. If inflation climbs, they raise the interest rate to dampen demand, and if growth slows, they reduce the cost of funds to fuel demand. Key Points

Economic Times

Current level of real repo rate raises worries of damage to growth: Jayanth R Varma

The objective of monetary policy is to control inflation with as little growth sacrifice as possible. The current real repo rate is close to 1.5% based on projected inflation 3-4 quarters ahead. At this level, there are worries about the extent of demand destruction that it will cause and the consequent damage to economic growth. Key Points

Economic TimesUS FOMC statement: Full text from Fed's monetary policy statement

The US Federal Reserve has kept interest rates steady at 5-5.25%, but indicated that rate hikes are expected in 2023. Inflation remains elevated. Key Points

mintMPC: RBI keeps interest rates unchanged for second time in a row, lowers inflation forecast

The Reserve Bank of India has left interest rates unchanged for the second consecutive monetary review meeting, suggesting it is in no rush to address the cost of funds as the inflation trajectory is sliding, with lower inflation forecast for the fiscal year. The central bank cited adequate supplies and an unlikely demand push as tepid global growth boosted expectations of further easing in commodity prices. Key Points

Economic TimesRBI keeps key repo rate unchanged at 6.5%, expects robust growth but inflation above 4% target

Repo rate was raised by 250 basis points between May 2022 and February 2023. Robust growth to provide space for monetary policy to remain focused on bringing inflation down to 4% target. Key Points

ThePrintChina central bank leaves medium-term policy rate unchanged as expected

The People's Bank of China (PBOC) said it was keeping the rate on 500 billion yuan ($69.51 billion) worth of one-year medium-term lending facility (MLF) loans to some financial institutions unchanged at 2.50% from the previous operation. Key Points

Economic Times

RBI Policy: Brokerages see continued pause, this is when they expect the first rate cut

The Reserve Bank of India's monetary policy committee kept the repo rate unchanged at 6.5%, with brokerages predicting a continued pause in policy rate cuts to assess the impact of tightening measures. Key Points

mintRBI policy: monetary policy committee keeps repo rate unchanged at 6.50%

The RBI's monetary Policy Committee (MPC) unanimously decided to keep the repo rate unchanged at 6.50 per cent, governor Shaktikanta Das said. Key Points

The Indian ExpressIndia monetary policy has to remain actively disinflationary: RBI Guv Shaktikanta Das

Reserve Bank of India Governor Shaktikanta Das stated at the World Economic Forum in Davos that India's monetary policy should remain actively disinflationary despite a recent drop in core inflation. While acknowledging the decline in core inflation, Das emphasized the need to maintain a disinflationary stance until headline inflation consistently reaches the target of 4%. He noted the global geopolitical situation's volatility and its potential impact on economies, particularly regarding food inflation. Das also highlighted the RBI's intervention in the exchange rate market to prevent undue volatility, emphasizing the stability of the rupee. Key Points

Economic TimesRBI monetary Policy 2024 LIVE Updates: RBI Governor Shaktikanta Das likely to keep repo rate unchanged

RBI MPC Meeting 2024 Live Updates: The RBI is widely expected to keep the key policy repo rate unchanged at 6.5% in its April monetary policy. Comments from the RBI Governor Shaktikanta Das will be keenly watched for any hints on future interest rate cuts. Key Points

MintView: China’s glut, India’s drought. Two faces of liquidity

The liquidity drought may be deliberate. Unlike Beijing, New Delhi has every reason to be sanguine about growth. A 7%-plus rate of economic expansion gives it breathing room to slay inflation before embarking on a fresh investment spree after the polls. Unless the Modi government surprises analysts by announcing a populist spending program in its Feb. 1 budget, the reasonable assumption is that its angling for an upgrade to its sovereign rating, which is perched at the lowest rung of investment grade. Meanwhile, the monetary authority is seeking to buttress its credibility as an inflation fighter. Key Points

Economic Times

India withstood geopolitical shocks; will navigate future uncertainties too: MPC's Jayanth R Varma

India's economy has proven its resilience in the face of geopolitical shocks over the past few years and will continue to navigate uncertainties in the future, according to Jayanth R Varma, a member of the RBI monetary Policy Committee. Varma expressed confidence in a positive outcome for 2024, with lower inflation and robust growth. Key Points

Economic TimesVegetable price shocks require experts to keep a watch on food inflation, says Crisil Ratings

The report is based on the Google Trends index using data from Google search volumes for a particular time period. With 600 million smartphone users in the country, the Google Trends data is likely to capture the larger sentiment of the country. The monetary Policy Committee (MPC) cannot directly control food inflation, but persistence of it can become generalised and enter headline inflation. This, in turn, would require a MPC response, Crisil said. Key Points

Economic TimesNifty crosses 21,000 for 1st time as RBI keeps repo rate unchanged

The Nifty 50 rose to an all-time high of 21,006.10 soon after Reserve Bank of India Governor Shaktikanta Das announced that the central bank’s monetary Policy Committee decided to keep the repo rate unchanged at 6.5 per cent. Key Points

India TodayRBI keeps repo rate unchanged at 6.5%, remains focused on tackling inflation

The decision to maintain the key repo rate at 6.5 percent marks the fifth instance when the 6-member monetary Policy Committee (MPC) has opted to keep the interest rates unchanged. Key Points

India TodayRBI MPC holds interest rates for the fourth straight monetary review

The Reserve Bank of India (RBI) has decided to maintain interest rates for the fourth consecutive monetary review meeting. The central bank is confident in the easing food prices and decreasing inflationary expectations within the country. However, it has also stated that it will take action if the global bond market turmoil has any adverse effects on the Indian economy. Key Points

Economic TimesRupee gains 6 paise to close at 82.75 against US dollar as crude oil weakens

Mumbai, Aug 7 (PTI) The rupee gained 6 paise to close at 82.75 against the US dollar on Monday, tracking positive domestic equities and lower crude oil prices. However, sustained foreign fund outflows and a stronger American currency in the overseas market dented investor sentiments, forex traders said. At the interbank foreign exchange market, the […] Key Points

ThePrintMarkets continue to trade higher post RBI policy decision

Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said the monetary Policy Committee (MPC) unanimously decided to keep the rate unchanged at 6.5 per cent. Key Points

FinancialexpressRBI may again pause repo rate at this week's policy meet: SBI Research

Besides putting a brake on the interest, the RBI is expected to downgrade inflation projections for 2023-24. The MPC is expected to once again opt for a pause in rate hikes during its bi-monthly monetary policy set to be held this week. Retail inflation is projected to moderate to 5.2 per cent for 2023-24 in India as estimated by RBI in its April monetary policy meeting; with Q1 at 5.1 per cent; Q2 at 5.4 per cent; Q3 at 5.4 per cent; and Q4 at 5.2 per cent. Key Points

Economic TimesRBI's monetary Policy Committee meet starts amid expectations of yet another rate hike

The Reserve Bank of India’s (RBI) rate-setting panel on April 3 started its three-day meeting amid expectations that the Central bank may go for 25 basis points hike in benchmark interest rate, probably the last in the current monetary tightening cycle that began in May 2022. Reserve Bank governor Shaktikanta Das-headed monetary Policy Committee (MPC) during its three-day meeting (April 3, 5 and 6) will take into account various domestic- and global factors before coming out with the first bi-monthly monetary policy for fiscal 2023-24. Key Points

The HinduRBI MPC Meet: Interest rates expected to hold steady, possible shift to neutral stance amid tight liquidit

RBI MPC Meet: The 12 respondents unanimously predicted that the monetary Policy Committee (MPC) would keep the repo rate unchanged at 6.50% at the end of its February 8 meeting. They said the panel will maintain the status quo on rates for the sixth consecutive time. The repo rate is the rate at which the RBI lends funds to banks. Key Points

Economic Times

Learn with ETMarkets: How does monetary policy easing impact gold investments?

Monetary policy plays a crucial role in influencing the performance of various financial assets, and gold is no exception. Gold has historically thrived during times of economic uncertainty, and one of the key drivers of its value is the prevailing monetary policy. When central banks opt for a more accommodative approach, such as lowering interest rates or implementing quantitative easing, it tends to create a favorable environment for gold investments. Key Points

Economic TimesRBI monetary policy: This is how Nifty may perform after the central bank announces its decision

Nifty is performing positively ahead of the RBI's monetary policy, with expectations that it may soon surpass its all-time high of 18,887.60. Majority of experts believe RBI may choose to keep repo rate unchanged for second consecutive policy. Key Points

mintHigh real interest rate may halt private investments, hinder pace of growth: MPC member Jayant Varma

Professor Jayant Varma, who was the sole dissenter at the February monetary policy meeting when the MPC held rates steady at 6.50%, voted for the repo rate to be cut by 25 basis points. Key Points

mintRBI monetary Policy: An interest rate cut emerges on the horizon

The Reserve Bank of India has kept interest rates unchanged for the second consecutive meeting of the monetary Policy Committee, with the repo rate remaining at 6.5%. Governor Shaktikanta Das suggested that the real interest rate meant a cut in policy rates was possible as the interest rate cycle may have peaked. The inflation target mandate, a monetary policy objective aimed at controlling the rate of price increases, emerged in 2016 after years of price increases led to negative real interest rates and spawned financial instability. Key Points

Economic TimesAsia shares wobble on China angst; long-end US bond yields rise with dollar

By Rae Wee SINGAPORE (Reuters) - Weak China markets dragged broader Asian shares lower on Thursday, while longer-dated U.S. bond yields rose alongside the dollar as investors assessed the monetary Key Points

ThePrint

Surprise Dissent! Who's the new rebel in RBI's monetary policy team?

The RBI appointed three new external members to its monetary policy committee, who influenced the shift to a 'neutral' stance on growth, despite differing views on the 6.5% repo rate. Nagesh Kumar emerged as a new dissenter advocating for a rate cut. Key Points

Economic TimesMarkets hold on to early gains after RBI monetary policy decision

Interest rate-sensitive bank, realty and auto stocks trading with gains. Benchmark equity indices jumped in late morning trade on Friday, extending their rally... Key Points

The Tribune IndiaRBI to keep repo rate revision on hold due to India's 'Goldilocks' economy: Report

The current repo rate is 6.50%, which was last updated on February 8, 2024. Since then the RBI has decided to keep the rate unchanged. Key Points

Business TodayRBI releases FY25 schedule for meetings of monetary Policy Committee

The meeting schedule for the second half of the next financial year is as follows – October 7-9, December 4-6 and February 5-7, the RBI said. The six-member MPC is the rate-setting panel of the central bank, comprising three RBI officials and three external members. After raising interest rates by a cumulative 250 basis points from May 2022 to February 2023, the MPC has maintained a status quo on monetary policy. END Key Points

Economic TimesLending rates to start easing only in second half of FY'25: Report

Bank deposit rates are unlikely to rise further. But the structural shift in the system will keep downward rigidity intact. Hence, banks lending rate is expected to remain high in FY25 with some modest softening towards the end. Key Points

Economic Times

Lower interest rates forecast for 2024, but geopolitical tensions can keep monetary policy on its toes

Globally, the tone of monetary policy has also become less hawkish, suggesting that the most challenging phase of the cycle of increasing interest rates is now behind. This positive development has opened up the possibility of interest rate softening in 2024 to support economic growth. Key Points

Business TodayRBI imposes monetary penalty on four Gujarat-based co-operative banks

New Delhi [India], December 22 (ANI): The Reserve Bank of India (RBI) has imposed monetary penalties on four co-operative banks, ranging from Rs 50,000 to Rs 7 lakh, for some non-compliances. The entities against which the penalties have been slapped are Progressive Mercantile Co-operative Bank Ltd., Ahmedabad, Gujarat (Rs 7 lakh), The Kutch Mercantile Co-operative […] Key Points

ThePrintSensex jumps 300 pts as RBI holds rate at 6.5%, Nifty above 19,600; “withdrawal of accommodation” stance r

The monetary policy action was on the expected lines, and therefore, equities remained steady post the announcement. The Sensex was trading 324 points or 0.49% higher at 65,955.89, while the Nifty was steady above the 19,600 mark.. The Nifty Bank index also was trading 0.3% up at 44338.10 points. Key Points

Economic TimesIndian shares set for flat open on weak global cues; Fed minutes eyed

Indian shares are set to open little changed on Wednesday amid caution due to concerns of escalating trade conflict between the U.S. and China, and as investors await the U.S. Federal Reserve's June monetary policy meeting minutes. Key Points

ReutersRupee opens 4 paise lower at 82.59 against US dollar ahead of RBI monetary Policy

In the Asian markets, the offshore Chinese yuan dropped below 7.1550 to the dollar, the lowest since November last year, on concerns over China’s economic outlook. Weighing on Asian currencies was the rise in US yields after a surprise rate hike by Bank of Canada (BoC). Key Points

mint

Rupee rises 5 paise to close at 82.55 against U.S. dollar

A research analyst said that Spot USDINR is expected to remain calm within the range of 82.20 to 82.90. Key Points

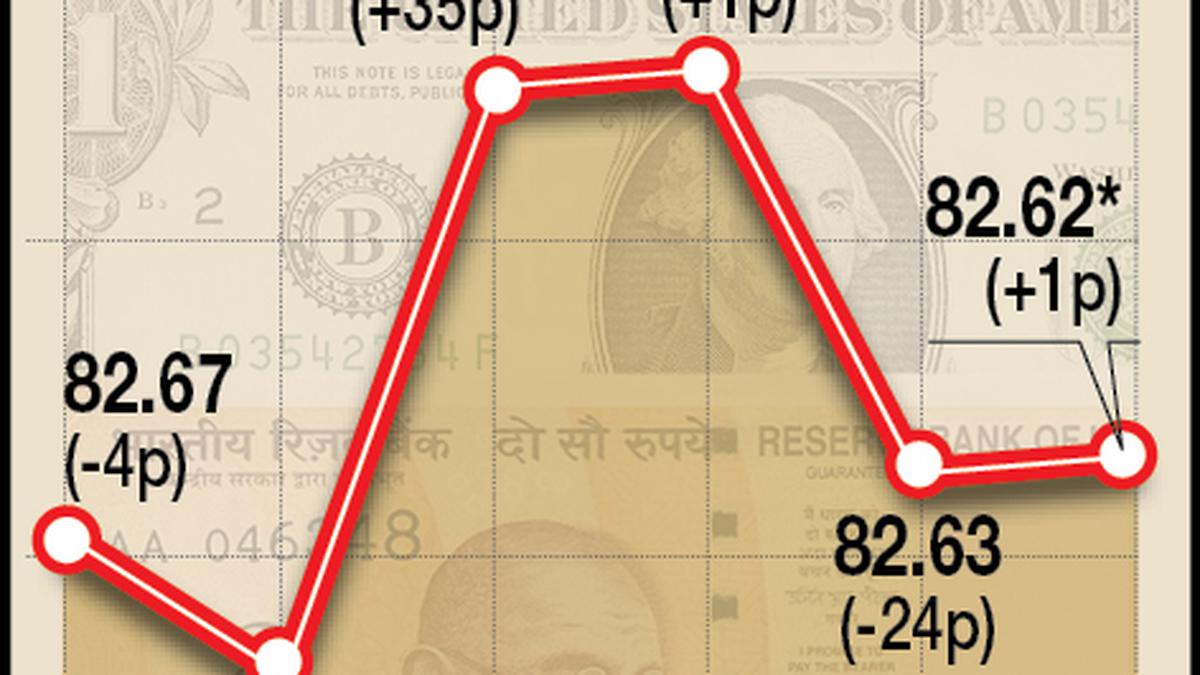

The HinduRupee rises 1 paisa to close at 82.62 against US dollar

At the interbank foreign exchange market, the local unit opened at 82.56 against the US dollar and settled at 82.62 (provisional), up 1 paisa over its previous close. Key Points

Financialexpress