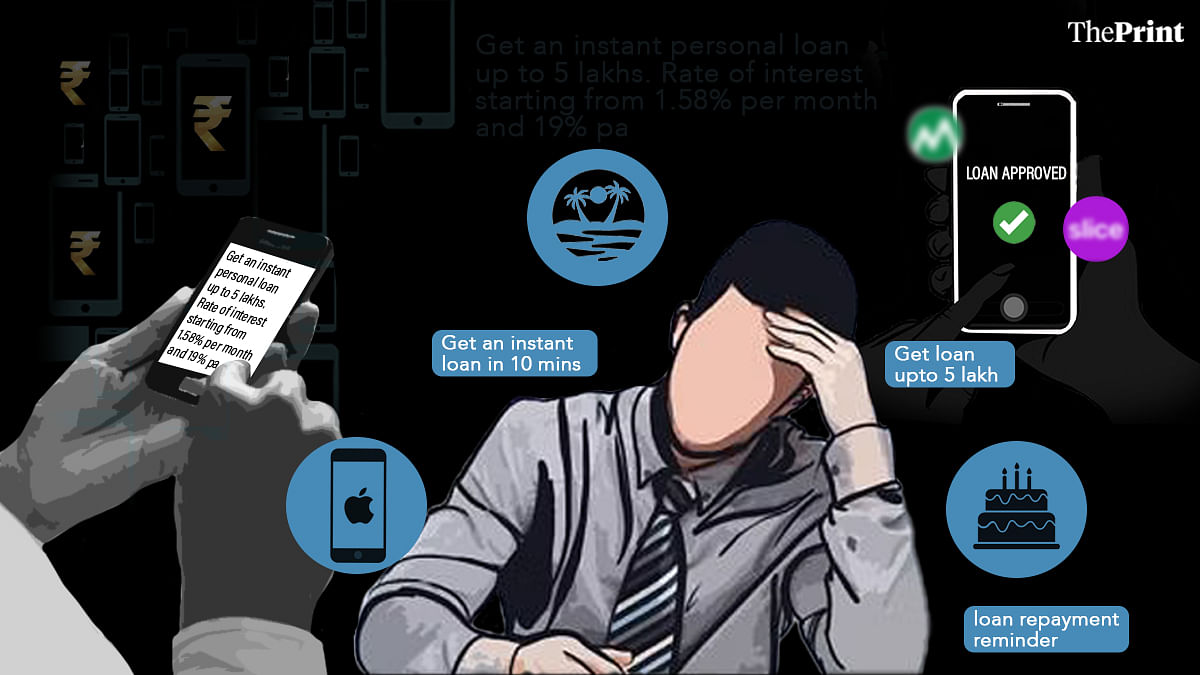

iPhone craze, Goa trips, to making ends meet, 'addictive' instant loan apps leading many into debt trap

Unsecured loans have been a concern for RBI for a while now. Last year, it took steps to make it more expensive for banks, NBFCs to give them out in bid to deter such borrowing. Key Points

ThePrintIndividuals, businesses are increasingly defaulting on microloans. Both lenders & borrowers at fault

Data from microfinance industry bodies shows microloan delinquency ratios are rising once again, after having fallen consistently 2021 onwards. Lenders must do deeper checks, say experts. Key Points

ThePrintFintech lenders have high delinquency levels in small value loans says RBI

The RBI has highlighted concerns over consumer loans, noting that over half of borrowers have three or more loans simultaneously. The Financial Stability Report flags high delinquency rates, especially among personal loans under ₹50,000 and loans from fintech lenders. Despite overall improvements in credit quality, stress in retail loans remains significant, particularly for private sector banks. Key Points

Economic TimesWhy RBI's disproportionate action against fintechs may be bad for business and investor sentiment?

In a situation where financial liabilities of citizens have grown from 3.8% to 5.8% of GDP between 2021 and 2023, is it not reasonable to expect that regulatory and supervisory actions are taken in a 'calibrated' fashion, keeping an eye on customers credit needs and financial convenience? In an age when gov and corporations promote light-touch digital solutions as a universal panacea, should regulatory boundaries remain static and stifle new lending models? Key Points

The Economic TimesBanks' NPAs at record lows as recoveries up

Banks' bad loans have fallen to record lows as recoveries rise and many missed payments are regularized. Lenders anticipate stress and are building buffers. Bad loans fell 21% to Rs 4.85 lakh crore. The gross bad loans ratio is expected to improve to 2.8% this year. Key Points

Economic TimesRBI bars IIFL Finance from disbursing gold loans; flags supervisory concerns

Mumbai, Mar 4 (PTI) The Reserve Bank on Monday barred IIFL Finance Ltd from disbursing gold loans, with immediate effect following multiple supervisory concerns, including serious deviations in assaying and certifying the purity of the yellow metal. A leading financial services provider, IIFL Finance offers a range of loans and mortgages. The latest directions from […] Key Points

ThePrintFintech personal loan disbursal doubles in 5 years, default drops

Financial technology companies have seen a significant increase in loan disbursal over the past five years, with personal loan volume and value surging. The average ticket size has decreased due to more small ticket loans. Loan delinquency rate was 3.6%, with West Bengal having the highest rate. Key Points

mintFintech loan defaults drop to pre-Covid level: Report

India Business News: loans provided by fintech companies through digital platforms have shown improvement in delinquency ratio, with a rate of 3.6% in Sept 2023. West Beng Key Points

Times Of IndiaRBI asks banks, NBFCs to share key facts on loans with all retail, MSME borrowers

The Reserve Bank of India (RBI) has requested banks and NBFCs to provide borrowers from retail and micro and small enterprises with a key fact statement (KFS) detailing loan agreement information, including all-in-cost. The move aims to increase transparency and disclosure in loan pricing by regulated entities. Key Points

Economic Timesloans from small time borrowers surge post COVID: Report

The report by CRIF Highmark provides insights into the portfolio at risk across various buckets. It ranges from 0.3% to 2.1% as of June 2023. The report also highlights that delinquency has improved across all individual MSME loans, except for construction equipment loans, where payments are due between 181-360 days. These findings assume significance in understanding the risk and performance of different loan segments. Key Points

Economic Times

SK Finance raises Rs 1,328 cr from TPG, Motilal Oswal

SK Finance raised Rs1,328 crore from existing investors Norwest Venture Partners, TPG Growth, Baring Private Equity India, and new investors Motilal Oswal's MO Alternate Investment Advisors, and Duro Capital. The funds will be used for brand, distribution, technology, and people. SK Finance, founded in 1994, offers commercial vehicle loans, car loans, tractor loans, two-wheeler loans, and secured business loans. It has a presence in 12 states with 500 branches and over 9,600 employees. Key Points

Economic TimesPersonal loan interest rate likely to rise up to 1.5%; loan eligibility norms to get tighter in 2024 with

Personal loan interest rates to go up in 2024: All lenders regulated by the RBI are required to hold capital in a certain proportion of the loan amount they lend. The riskier the loan, higher the capital a lender has to maintain. As a direct consequence of the RBI raising the risk weightage, lenders now have to maintain higher capital reserves for the riskier category. What changes for the lenders? Read on to know how much more you will have to pay for your next personal loan. Key Points

Economic TimesPersonal loans to get costlier? Interest rates likely to rise by up to 1.5% in 2024 with new RBI rules

Find out why personal loans in India are set to become more expensive in 2024. Learn about the recent rule changes by the Reserve Bank of India (RBI) and how they will impact the cost of unsecured lending. Discover the potential increase in interest rates and stricter eligibility criteria for borrowers. Key Points

Times Of IndiaA prudential approach to risk management must not hold back credit availability for the needy

Unsecured retail loans are not necessarily unproductive even if lending practices need to change. Easy financing options have given people access to smartphones, for example. Key Points

mintBanks quietly tweak interest rates for auto and personal loans

Interest rates on select retail loans, excluding home loans, are rising as banks adjust their marginal cost of lending rates (MCLR). While the RBI has kept the repo rate unchanged since February 2023, loans such as auto and personal loans not linked to the repo rate, are affected. SBI and other banks have increased rates, citing increased fund costs and market tightness. Key Points

Economic Times

NBFCs must look beyond banks for source of funds

The Reserve Bank of India (RBI) reported that non-banking financial companies (NBFCs) expanded 15% in FY23, with improved profitability and asset quality. However, the RBI emphasized the need for NBFCs to diversify and look beyond traditional banks for funding. Key Points

Economic TimesConstruction Loans, Like Holiday Guests, Might Hang Around Too Long

Banks’ commercial real-estate lending has grown about as fast as consumer loans so far in 2023. Here’s why. Key Points

mintRBI policy on stability: Will not wait for house to catch fire

The Reserve Bank of India (RBI) has defended its recent regulatory measures for banks and non-banking finance companies (NBFCs), emphasizing its commitment to using prudential tools to safeguard financial stability. Governor Shaktikanta Das stated that the central bank will not wait for problems to escalate, likening it to waiting for a house to catch fire before taking action. Key Points

Economic TimesPaytm stock takes a big hit as it pulls back on small loans

Postpaid loan disbursement is expected to halve in the coming months, the company said. Investors were visibly upset, dragging the stock down almost 19% on Thursday. Key Points

mintIndian banks ask fintech partners to limit tiny personal loans amid regulatory glare: Sources

Amid regulatory concerns, top Indian banks and non-bank lenders have advised fintech partners to reduce issuing small personal loans. Paytm on Wednesday announced it will go slow with loans below 50,000 rupees, aligning with RBI's cautionary stance on personal loans and NBFC lending due to rising risk concerns, prompting lenders to reconsider their lending strategies. Key Points

Economic Times

Paytm shares tank 20% after company looks to curtail low-value personal loans

Paytm said it will expand its portfolio of higher-ticket personal and commercial loans to lower-risk and high-credit-worthy customers, expecting good demand for loans of more than Rs 50,000. This comes after the Reserve Bank of India (RBI) recently raised the amount of capital that banks and non-bank lenders need to set aside to cover potential defaults when giving out personal loans. Key Points

Economic TimesIndia's Paytm to give out fewer low value personal loans

Indian digital payments firm Paytm (PAYT.NS) said on Wednesday it will cut down on disbursing loans under 50,000 rupees ($600.14), weeks after the central bank tightened rules on consumer lending after a surge in demand. Key Points

ReutersRBI's new lending norms: NBFCs play up spectre of collateral damage, knock on regulator's doors

In a written communication to the apex bank, NBFCs -- lend to small businesses and provide secured loans -- have sought lower risk weightage on bank loans sanctioned to them. They have also requested an appointment with the RBI. Key Points

Economic TimesFedbank Financial offers exposure to the fast growing MSME lending business

True North Fund, a private equity firm and the selling investor, will reduce its stake to 14.4% from 25.4%. The lender focuses on rapidly growing segments of micro, small and medium enterprises (MSME), self employed individuals and gold loans. Key Points

Economic TimesRBI's consumer loan action is credit positive: Moody's

Moody's Investors Service has said that the Reserve Bank of India's decision to increase risk weights on unsecured personal loans will improve lenders' loss-absorbing buffers and be credit-positive. The rapid growth of unsecured loans has exposed financial institutions to a potential spike in credit costs in case of sudden economic or interest rate shocks. Key Points

Economic Times

A ritualistic risk dance begins as the political stakes start to rise

RBI’s belated tightening of personal-loan rules suggests that regulatory checks remain tied to the Indian electoral calendar. Authorities seem to be comfortable with excessive speculation during normal times but acquire jitters just before polls. Key Points

mintRBI’s new loan norms aimed at protecting unsuspecting consumers

Tightened capital norms also signify support for better asset quality for lenders. The Reserve Bank of India on Thursday tightened norms for consumer credit/personal loans. It asked banks and NBFCs to assign a higher risk weight for unsecured personal loans, a move aimed at making lenders more cautious and at the same time also protect consumers. Key Points

The Tribune IndiaNot just risk to banks, RBI’s curbing unsecured lending to rein in shady recovery practices too

RBI has made it more costly to lend & borrow unsecured loans. One reason is financial risk these loans can pose, while another is harassment of borrowers by recovery agents. Key Points

ThePrintNew regulatory risk weights will hit Indian banks' capital adequacy by 60 basis points: S&P

The RBI increased risk weights on unsecured personal loans, credit cards, and lending to nonbank finance companies (NBFCs) by 25 percentage points on Thursday. S&P Global Ratings noted that the move will likely lead to higher lending rates, lower credit growth, and an increase in the need for capital raising among weak lenders. Key Points

Economic TimesRBI's risk weight hike on consumer credit: Slowing the party, not ending it

RBI has pulled the punch bowl from the consumer loans party. Does that mean the party has come to an end. Hardly. The music is still on and many will remain on the dance floor. What it does is that it would contain the damage whenever it happens than what it would otherwise have been. RBI has raised risk weight on consumer credit by banks and NBFCs to 125%, compared to 100% earlier. An ET explainer. Key Points

Economic Times

Why RBI is making it tough for you to get a personal loan

Unsecured loans, though small in size, can pose a risk to the financial system if their expansion goes unchecked. The RBI observed an unusual growth of approximately 23 percent in unsecured loans, surpassing the country's average credit growth of 12-14 percent. This surge has even exceeded the overall bank credit growth of around 15 percent witnessed in the past year. Key Points

Economic TimesSensex Today | Share Market Live Updates: Sensex, Nifty expect positive start; Gift Nifty in green

Sensex Today | Share Market Updates: The Indian stock market is expected to gain at the start amidst mixed global cues and Gift Nifty trading higher than yesterday's close. Wall Street ended on a mixed note on Thursday, while Asian markets are also sluggish in today's trading. Key Points

MintRBI tightens capital norms for unsecured retail loans

The Reserve Bank of India (RBI) increased risk weights on consumer loans from banks, non-banking finance companies (NBFCs) and credit card providers, making it more expensive for lenders across the spectrum to offer loans in these segments. That will mean higher interest rates for all borrowers. Key Points

Economic TimesRBI tightens norms for consumer loans amid rise in unsecured lending

The Reserve Bank of India has increased risk weights for consumer credit exposure in commercial banks, including personal loans, by 25 percentage points to 125%. This comes after warning about the risks of surging personal loans. Unsecured loans have been an outlier at 23%, compared to an average of 12%-14%. This has led to record borrowing and household savings dropping to multi-year lows. Key Points

Economic TimesBank margins hit by higher funding costs, trend likely to continue

NIM, the difference between the yield a bank earns on loans and that it pays on deposits, dropped to 3.43% for SBI but ICICI held on to its margins at 4.53%. Smaller banks like Federal Bank also saw a 14 basis points drop in NIM year on year to 3.16%. Key Points

Economic Times

Reserve Bank not looking to tighten banks' unsecured lending norms - sources

The Reserve Bank of India (RBI) is not currently planning to make any changes to its regulations on banks' unsecured lending portfolios, as there is no widespread stress in the sector. While Indian banks have seen a significant increase in unsecured loans, such as personal loans and credit cards, the issue is limited to a few banks and is not yet considered systemic. Key Points

Economic TimesDepositors benefit more than borrowers this rate hike cycle

“The demand for funds is high given the credit growth of 15-16 percent. Banks need to garner more funds through deposits even at higher rates” said Sachin Gupta, chief rating officer CareEdge Ratings “ Besides some banks are focusing on building durable long-term and stable funding sources even if it means paying higher interest.” Key Points

Economic TimesReset of floating rate home loan EMIs to get more transparent, option to switch to fixed interest rate soo

RBI asks banks to be more transparent in resetting of interest and EMIs of floating rate home loans under external benchmark based lending rate. The banking regulator has also asked the banks to offer the borrowers an option to switch to floating rate. The banking regulator has also asked the banks to be refrain from changing the tenure unreasonably without borrower's consent. Key Points

Economic TimesDon't camouflage stress, extend loans for reasonable period: Shaktikanta Das to banks

India's Reserve Bank Governor, Shaktikanta Das, has called on banks not to camouflage stress and extend loans only for a reasonable period of time. The borrower's age and ability to repay must be considered, whilst extending loan tenors, he said. Retail loans including long-tenor housing loans, have been extended to longer periods due to rate hikes imposed by the RBI. Key Points

Economic TimesRBI's lending innovation: Can't prove creditworthiness? Now you will still get a loan

The Reserve Bank of India (RBI) is developing a Public Tech Platform for Frictionless Credit delivery through end-to-end digital lending processes, beginning with Kisan Credit Card and dairy loans. RBIH, the RBI's wholly owned subsidiary that accelerates innovation in the financial sector, is piloting its platform in five states and plans to expand its offering to include education loans, MSMEs, and vehicle and personal loans. It will allow lenders to tap into data on milk sales or land records to establish creditworthiness, speeding up the loan application process from its current two to three weeks to a few minutes. Key Points

Economic Times

Bank lending up 16.3% in June: Indians in the mood to buy drive credit growth

In aggregate terms, bank loans advanced 16.3% in June. Retail loans climbed more than a fifth on year, supported mainly by home and vehicle loans, the latest central bank data showed. Bank loans to non-bank lenders climbed, and so did the disbursements to large companies. Key Points

Economic Timesloans against MFs catch fancy with easy process & low rates

Though public and private sector banks offer this product, non-banking finance companies (NBFCs) have been more aggressive. The selling pitch for loans against mutual funds is that you do not have to liquidate your performing schemes for want of short-term funds. Key Points

Economic TimesAnalysis: Fintech lenders tighten lending standards, bolstering debt financing

U.S. financial technology companies are tightening their lending standards, a move that has bolstered their access to debt financing from Wall Street investors, according to industry executives. Key Points

ReutersAnalysis: Banks step up U.S property loan tweaks to limit defaults

Banks are showing a growing willingness to rework the terms of U.S. commercial real estate loans to prevent defaults, mitigating near-term losses but also masking growing stress in some parts of the market. Key Points

ReutersShare of housing loans in total advances rises to 14.2 pc in 11 years: RBI report

The share of residential housing loans in total advances has increased over the last eleven years to 14.2 per cent in March 2023 from 8.6 per cent in March 2012, as per the Reserve Bank's latest Financial Stability Report (FSR). The share of residential housing loans in total loans has increased over the last eleven years to 14.2 per cent in March 2023 from 8.6 per cent in March 2012, the report said. Key Points

Economic Times/cloudfront-us-east-2.images.arcpublishing.com/reuters/BLPVH6NJEVMB3IVQE4CUDYJ2I4.jpg)

Commerzbank to book further provision for mBank after court ruling

Germany's Commerzbank said on Friday that it would book another provision of 342 million euros ($372.27 million) following a court ruling on how banks treat Swiss franc loans in Poland. Key Points

ReutersSoaring unsecured lending may need regulatory intervention

The Reserve Bank of India may need to tighten retail credit norms as the unsecured loan portfolio for the banking sector doubled in four years to reach INR 11.1tn ($148bn) and risky borrowing among less-privileged sectors grew. Unsecured personal loans circulated by banks and NBFCs rose 20.2% in Q4 2022 over the same period the previous year. Key Points

Economic Times