Converting PNG to JPG: Know how to Convert Image and Web Files

It need not be difficult to convert picture file types. You may easily convert PNG to JPG format or other formats using the built-in utilities on your PC or Mac, as well as third-party applications and internet conversion tools. Key Points

Economic TimesMicrosoft Windows 11 Insider Preview build gets easy photo access, improved privacy setting

Microsoft in its Windows 11 Insider preview added the Gallery feature in file Explorer, along with improvements in privacy settings and other fixes. To learn more, read this story on The Hindu. Key Points

The HinduGSTR-1 vs GSTR-3B vs GSTR-9: How do three returns differ for businesses

Ease of doing business for MSMEs: There are around 22 types of GST returns, of which around 4 are suspended and eight are view-only in format. The remaining 11 have to be filed depending on the taxpayer category. Key Points

FinancialexpressDelhi power subsidy scheme: L-G, Atishi lock horns yet again

Atishi said the Delhi government could not move forward with the disbursal of the requisite funds till the file was returned to it from the L-G’s office. She said the issue of the funds for the scheme was flagged to her in a letter by one of the private power distribution companies. Key Points

The Indian ExpressGTA 6 leaked rumours suggest file size could exceed 300GB, drawing mixed reactions

The highly anticipated GTA 6 is generating buzz with rumors of a massive 320GB file size, sparking debates among gamers. Some embrace the potential, while others criticize its impracticality. Key Points

mint

Pakistan-based threat actors attacking IITs, Indian Army: Modus operandi, motive, and other details to know

Pakistan-based group Transparent Tribe has been conducting cyber attacks against the Indian Army and education sector. The group is believed to be attempting to obtain sensitive information via the malicious file ‘Revision of Officers posting policy’, which is disguised as a legitimate document. Key Points

mintYet to finalise mechanism for regulating cryptocurrencies: Centre to SC

The Centre has informed the Supreme Court that it is yet to decide on a mechanism to regulate cryptocurrencies and investigate related offences. Additional Solicitor General Vikramjit Banerjee stated that the government is deliberating on the regulation of digital currencies and needs more time to file an affidavit with updated information. The court emphasized the need for appropriate safeguards against fraud and misuse of cryptocurrencies. The matter will be further heard on March 21. Key Points

Economic TimesNo relief for Kejriwal: Delhi HC refuses to interfere with Delhi CM's ED arrest, next hearing set for Apri

Justice Swarana Kanta Sharma has set the next date for the hearing on April 3, with the central agency required to file a response the day before. The Justice said that the ED has to be granted an opportunity to file a reply, as an opportunity for effective representation. Key Points

Economic TimesWoman gets 6-month jail for not filing ITR; who has to mandatorily file income tax return, consequences of

Who has to file ITR: The decision was made following a complaint from the Income Tax Office (ITO), alleging that Rs. 2 lakh was deducted as TDS (tax deducted at source) from a receipt of Rs. 2 crore received by the accused in the fiscal year 2013-14. Despite this, the accused failed to file an income tax return for the assessment year 2014-15. Key Points

Economic TimesOver 6 crore ITRs filed till 30 July: Income tax dept

Those who file their returns after the due date but before 31 December will have to pay a fine of ₹5,000. If filed after 31 December, the fine increases to ₹10,000. Key Points

mint

CBIC extends deadline for filing April GST return for Manipur-based biz till May 31

Registered businesses in Manipur, a north-eastern state in India affected by ethnic clashes, have been granted an extension until 31 May to file monthly GST returns. The previously specified deadline dates had been due in May but have been pushed back due to ongoing political violence. The filing of GSTR-1, the statement of outward supplies, was postponed from 11 May, while GSTR-3B, the monthly tax payment form, and GSTR-7, for businesses that deduct tax at source, were set for 20 May and 10 May, respectively. Key Points

Economic TimesFake Google Chrome error pages used to target users: Report

Fake Google Chrome error pages are being used to target users to run a malicious campaign. To learn more, read this story on The Hindu. Key Points

The HinduITR-2, ITR-3 for FY 2023-24 notified by CBDT; More details required from certain taxpayers

ITR-2 and ITR-3: Income tax return (ITR) forms have been notified by the central board of direct taxes (CBDT) via an notification in e-gazette. ITR-2 is to be filed by those who have capital gains income and are ineligible to file ITR-1. Do note that ITR-3 is to be filed by those entities who have income from business or profession. Key Points

Economic TimesTaxman to reach out to 15.2 m individuals required to file ITRs

Income-tax dept to act against 15.2 million non-filers. CBDT orders outreach from April 15. Focus on bank transactions, penalties for defaulters with high cash deposits. Key Points

Economic TimesWhat is the last date to file GST annual return and who should file it?

Goods and Services Tax (GST) annual return has to be filed by every GST registered individual whose annual turnover is over a specified limit. However for filing GST annual return, taxpayers have to file their monthly or quarterly GST return first. GST annual return has to be filed using GSTR 9 and GSTR9C if required. Key Points

Economic Times

Over 6.5 cr ITRs filed till evening; may cross 7 cr

Despite several representations from businesses, the income-tax department refused to extend the date for filing tax returns. Officials, however, said that the tax department will offer relief in penalty for those taxpayers who could not file their returns because of genuine difficulties. Key Points

Economic TimesWill government extend ITR filing deadline due to widespread floods in India?

ITR filing deadline: The income tax return filing deadline is July 31, 2023. Many taxpayers and CA associations are requesting for an extension of the ITR filing deadline in certain states as a result of floods in certain areas disrupting the lives if individuals. Key Points

Economic TimesWho can and cannot file income tax return using ITR-1 for FY 2022-23?

Not everybody can file ITR-1 (Sahaj) especially if they have any income from capital gains or income from cryptocurrencies or virtual digital assets (VDA), multiple house property incomes. Apart from this, there are other transactions which might make someone ineligible for filing ITR-1. Read on to find more about this. Key Points

Economic TimesCentre notifies amnesty scheme allowing filling appeal under GST till January 31, 2024

In a detailed notification issued Tuesday, the central Board of Indirect Taxes and Customs (CBIC) said that to file an appeal, appellant has to partially pay the penalty or interest out of disputed order, have to pay 12.5% of the disputed tax amount or Rs 25 crore out of which 20% payment has to be done via electronic cash ledger. Key Points

Economic TimesIndependent candidate from Karnataka’s Yadgir pays Rs 10,000 deposit money in coins collected from voters

An independent candidate from Karnataka’s Yadgir constituency paid his deposit money of Rs 10,000 entirely in coins to file nominations for the elections. He collected money from people across the constituency, to contest the Karnataka elections on May 10. Key Points

The Tribune India

CBDT enables ITR filing for FY 24; 23,000 returns filed in 4 days

ITR Form 1 (Sahaj) and ITR Form 4 (Sugam) are simpler forms that cater to a large number of small and medium taxpayers. ITR-2 is filed by people having income from residential property). Key Points

Economic TimesDidn't read file: Supreme Court adjourns Mahua Moitra's expulsion hearing to Jan 3

The Supreme Court adjourned the hearing on Trinamool Congress leader Mahua Moitra's challenge to her Lok Sabha expulsion to January 3. Justice Sanjay Khanna said that the bench did not get time to read the file. Key Points

India TodayUS conducted countervailing probe on certain Indian goods: Anupriya Patel

The US has conducted countervailing investigations on certain Indian goods, including paper file folders and common alloy aluminum sheet, according to Minister of State for Commerce and Industry Anupriya Patel. The European Commission (EC) has also conducted a similar probe on certain graphite electrode systems. Key Points

Economic TimesZerodha's Nithin Kamath warns people of illegal predatory loan apps

Zerodha founder Nithin Kamath warns of rising cases of harassment by predatory loan apps, advises victims to file complaints at cybercrime.gov.in or call 1930 Key Points

mintWhatsApp for beta now lets you send HD quality photos, here is how

WhatsApp is finally offering an option to send high-quality photos to contacts. The HD quality option is only visible when you try to send a large-quality file from WhatsApp. Here are all the details. Key Points

India Today

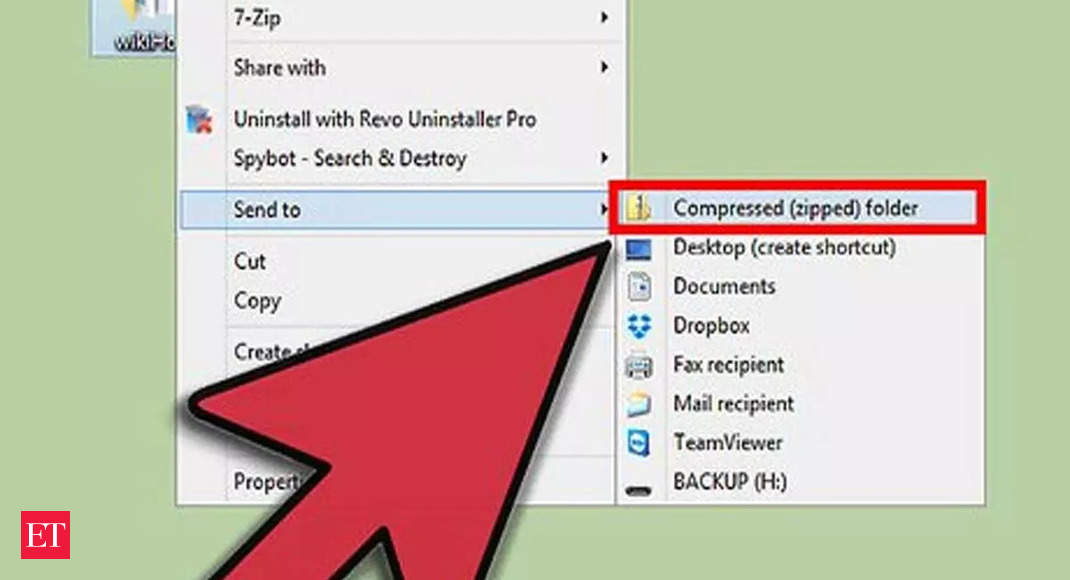

Here's how to ZIP files and save space on Windows, Mac, Chromebook, Linux: A complete step-by-step guide

When you zip or compress a file, your device keeps the file but it reduces its storage space on your computer or phone. In case of zip files, you dont need a third party application as most devices come with built-in tools for zipping and unzipping files. Key Points

Economic TimesAmid row, LG Saxena approves extension of power subsidy in Delhi

Earlier in the day, Delhi's Energy Minister Atishi said The file relating to subsidy has been stopped by the Lieutenant Governor. Due to this, 46 lakh consumers of Delhi will not be able to get electricity subsidy. Key Points

Economic TimesDaily brief: Assam CM threatens to file defamation case against Rahul Gandhi

Here are today’s top news, analysis, and opinion. Know all about the latest news and other news updates from Hindustan Times. | Latest News India Key Points

Hindustan TimesITR-1, ITR-2, ITR-4 forms for FY 2023-24 (AY 2024-25) available now on e-filing income tax portal

ITR filing forms for FY 2023-24: As of April 1, 2024, the online ITR forms have been enabled. This means that taxpayers who are eligible to file their tax returns using these forms can now proceed to file their ITR for the financial year 2023-2024. Key Points

Economic TimesMissed ITR filing deadline of July 31 for FY 2022-23? Don’t forget to file belated ITR by Dec 31

If you have missed the income tax return (ITR) filing deadline of July 31, 2023, then you have time till December 31, 2023 to file a belated ITR. Also, if there is a mistake in the belated or original ITR, then also you can file revised ITR. The last date to file belated and/or revised ITR is December 31, 2023. Key Points

Economic Times

Bilkis Bano case | SC lashes out as Centre, Gujarat claim privilege over remission files

The Supreme Court had sought a response from the Centre, Gujarat government and others on a plea filed by Bilkis Bano, who was gang-raped and seven members of her family were killed during the 2002 post-Godhra riots. Learn more about the latest updates on this ongoing case at The Hindu. Key Points

The HinduLok Sabha Election 2024 Live Updates: Rahul Gandhi to file nomination from Wayanad today

Lok Sabha Election 2024 news Live: Rahul Gandhi is set to file his nomination papers for the Wayanad Lok Sabha seat in Kerala on Wednesday. Later, Gandhi will also lead a roadshow in Kalpetta. The 2024 Lok Sabha elections will have the second-longest voting period in history after the first parliamentary elections. The elections, spread over 44 days, will be held in seven phases from April 19 to June 1, the Election Commission of India announced. The results will be declared on June 4. Stay tuned for all live updates. Key Points

India TodaySC slams IT department for filing cases after time limit

The Supreme Court criticized the income-tax department for filing petitions belatedly, highlighting a delay of over four years in an appeal against Bharti Airtel Ltd. The court urged the department to establish a proper litigation policy, noting its status as the biggest litigant in India. Rejecting the appeal, the court cited the department's tendency to reopen cases after sporadic successes, emphasizing the need for more judicious litigation practices. Key Points

Economic TimesIncome Tax Returns 2023-24: CBDT notifies ITR-2 and ITR-3; key details taxpayers will have to now provide

India Business News: The Central Board of Direct Taxes (CBDT) has released the Income Tax Return (ITR) forms, ITR-2 and ITR-3, for the financial year 2023-24. Taxpayers need to be aware of the filing requirements and changes in ITR-2. ITR-3 is for entities with income from business or profession. The deadline for submission is July 31, 2024, or October 31, 2024, for taxpayers with income tax audits. Key Points

Times Of IndiaCourt denies permission to Mansoor Ali to file defamation suit against Trisha

The court imposed a fine of ₹1 lakh on Mansoor Ali Khan. The court directed the actor to deposit the amount with the Adyar Cancer Institute in Chennai. Key Points

Hindustan Times

US Visa Bulletin for January 2024: Indians in Green Card queue advance; Check your status

To file an EB adjustment application in January 2024, foreign nationals must possess a priority date earlier than the listed date for their preference category and country. For categories with specific dates listed, only applicants with a priority date earlier than the specified date may submit their applications. Key Points

Economic TimesJet Airways insolvency: NCLAT adjourns hearing to Nov 1 as creditors seek more time to file reply

Last week, Additional Solicitor General N Venkataraman, representing lenders including SBI and other banks, told NCLAT that there are apprehensions about the source of funds, which deposited the money for Jalan-Kalrock Consortium's (JKC). The payment is not compliant with the resolution plan as it mandates that the money is to be paid through JKC, ASG had submitted. Key Points

Economic TimesBilkis Bano case: SC to hear arguments on pleas challenging premature release of 11 convicts on Oct 9

The Supreme Court has scheduled arguments on October 9 regarding petitions challenging the premature release of 11 convicts in the Bilkis Bano gangrape case and murder of her family members during the 2002 Gujarat riots. The court has asked the petitioners, including Bilkis Bano, to file their short written rejoinder arguments. The court also questioned whether convicts have a fundamental right to seek remission, stating that state governments should not be selective in granting remission to convicts. Several other PILs have challenged the relief granted to the convicts. Key Points

Economic TimesITR filing last date 2023: Don't miss this final step after filing your income tax return. What tax department says

ITR filing last date is July 31, 2023. Over 5 crore tax returns have been filed so far, with 88% e-verified. Key Points

mintNew forms or old? Clarity on annual company filings soon

The clarification is expected before the peak filing season begins this year. The new forms will be web-based and will enable real-time checking of data keyed in. Key Points

mint

Lt Governor clears Delhi Cabinet reshuffle, Atishi gets finance and revenue

The Delhi government on Thursday gave minister Atishi additional charge of finance and revenue departments, which were previously held by Kailash Gahlot. Atishi is now in charge of 12 departments, including education and power. Key Points

India Today