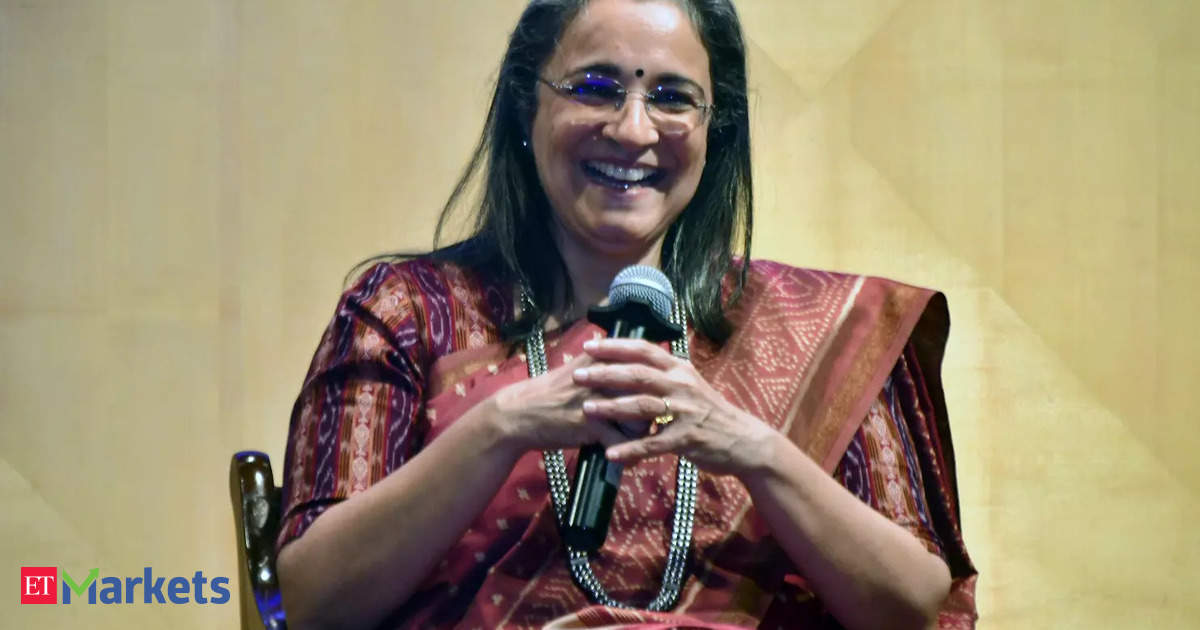

Hindenburg attacking Sebis credibility, indulging in character assassination of its chief: Chairperson Madhabi Puri Buch and husband Dhaval Buch

Mumbai, August 11 US-based short seller Hindenburg Research is attempting to attack Sebi's credibility and indulging in character assassination of its chairperson, SEBI chief Madhabi Puri Buch and her husband Dhaval Buch said on Sunday. In a detailed statement issued... Key Points

The TribuneOppn demands JPC probe; bid to create financial chaos: BJP

Aksheev Thakur Tribune News Service New Delhi, August 11 The Congress on Sunday reiterated its demand for a Joint Parliamentary Committee (JPC) probe into the Hindenburg row and said the Centre must act to eliminate all conflicts of interest in... Key Points

The TribuneSEBI tightens front-running regulations for AMCs to check market abuse

Asset Management Companies are required to put in place a structured institutional mechanism for identification and deterrence of potential market abuse. While SEBI will specify the broad framework of the institutional mechanism, industry body Association of Mutual Funds in India (Amfi) will have to detail on standards for such an institutional mechanism. Key Points

Economic TimesSEBI clears measures to facilitate ease of doing biz for FPIs, other entities

Mumbai, Mar 15 (PTI) Regulator SEBI on Friday approved a slew of measures to further improve the ease of doing business for market participants, including providing relaxations to Foreign Portfolio Investors (FPIs) and entities looking to raise funds through initial share sale. The proposals were cleared by the SEBI board during its meeting on Friday. […] Key Points

ThePrintSEBI board approves easing additional disclosure norms for FPIs

The relaxations in certain disclosure norms are aimed at ease of doing business. Further, the market regulator has also approved a Beta version of optional T+0 settlement, for a limited set of 25 scrips, and with a limited set of brokers. The optional settlement will be rolled out from March 28. Key Points

Economic Times

SEBI chief flags bubble in midcap, smallcap space

Madhabi Puri Buch, SEBI chairperson, expresses concerns over stretched valuations of small- and mid-cap stocks favored by retail investors. AMFI directs mutual funds to provide additional disclosures. SEBI plans to bring in more disclosures on risk factors and allow T+ 0 trade settlement. Key Points

Economic TimesSEBI using AI for investigations, says official

In response to a question by PTI on whether SEBI is using AI, Varshney said, we are using Al for investigations... and also using for a lot of things . Key Points

Economic TimesSEBI using Artificial Intelligence for investigations, says official

India Business News: The Security Exchange Board of India (Sebi) has been using Artificial Intelligence (AI) for its investigations. Referring to the instances of stock market manipulations, Varshney said adhering to the law will be more beneficial and violation will cause problems. The Securities and Exchange Board of India (Sebi) has been taking action against violators as well as measures to enhance transparency and curb misdoings. Key Points

Times Of IndiaZee negotiating with Sony to revive scrapped merger deal? Media firm responds

ZEEL shares surged 8 per cent, closing at ₹193 on the BSE and ₹190.40 on the NSE. Key Points

Hindustan TimesET Explains: Allegations against Adani Group, SEBI probe and SC Order

Supreme Court recently rejected pleas to either form a special investigation team (SIT) or direct the Central Bureau of Investigation (CBI) to probe US short-seller Hindenburg Research's charges against the infrastructure conglomerate. Now, SEBI will now be the sole regulator examining allegations of rule violations by Adani Group. The case is based on US-based short seller Hindenburg Research published a report alleging malfeasance by the Adani Group. Key Points

Economic Times

Adani-Hindenburg case: SC says no grounds for probe by SIT or CBI, SEBI to continue investigation

CJI-led bench was hearing petitions seeking court-monitored probe into Hindenburg Research report's allegations of stock price manipulations. 'Truth prevailed,' Gautam Adani posts on X. Key Points

ThePrintBig relief to Apollo Tyres as Supreme Court dismisses SEBI appeal

In 2018, SEBI had penalised Apollo Tyres on the grounds that 6.90 lakh shares of Apollo Tyres were bought back by the company and its promoters in contravention of the relevant section of the Companies Act and SEBI regulations. A bench led by Justice Sanjiv Khanna during the hearing pulled up SEBI for appealing against the SAT orders and also asked it to give a list of appeals that it had filed against the tribunal's orders. Key Points

Economic TimesCan't accept Hindenburg's Adani claims as ipso facto correct, no reason to doubt SEBI probe, says Supreme

An apex court bench rallied behind the regulator, saying it found no material to doubt the SEBI investigation or the impartiality of the expert committee headed by former Supreme Court judge Abhay Manohar Sapre. The panel had been appointed by the top court on March 2 to examine regulatory mechanisms to protect investor interests, following the January report by the US-based shortseller that sent Adani stocks tumbling. Key Points

Economic TimesAdani-Hindenburg case: SEBI tells SC it won't ask for probe timeline extension

Market regulator SEBI has informed the Supreme Court that it will not seek an extension to complete its probe into the Adani-Hindenburg matter. The Supreme Court-appointed expert committee found no evident pattern of manipulation in Gautam Adani's companies and no regulatory failure. However, SEBI's probe into alleged violation in money flows from offshore entities has drawn a blank . Key Points

Economic TimesSEBI turns up heat on influencers as stocks boom

The Securities and Exchange Board of India last week barred Mohammad Nasiruddin Ansari and two other entities linked to him from the market and ordered them to refund 172 million rupees ($2.1 million) taken from followers. Ansaris YouTube channel has close to half-a-million subscribers. His web portal provided investment advice under the guise of offering educational training, SEBI said. Key Points

Economic Times

Explained: Who is Baap of Chart and why is SEBI cracking down against finfluencers

Sebi received a complaint against Ansari claiming that he has been looting retail traders by showing assured returns. Although he himself has been making losses, Nasir has assured his students returns with a 100% guarantee. Ansari, who calls himself the Baap of Chart, on social media, has about 4.4 lakh followers on YouTube and more than 7 crore views. His X profile claims that he is managing a Rs 30 crore-fund and aims to take it to Rs 1,000 crore. Key Points

Economic TimesSEBI may tell SC Adani inquiry began after a tip in 2014, but hit dead end

SEBI restarted investigations into the group this year after U.S.-based short-seller Hindenburg Research raised governance concerns - allegations Adani Group has denied. Key Points

Business TodayAdani-Hindenburg saga: SEBI files status report, says awaiting details from external agencies on two probe

Markets regulator SEBI in an affidavit informed the Supreme Court that out of its 24 investigations in the Adani-Hindenburg matter, 22 are final in nature and 2 are interim. SEBI is now awaiting from external agencies on two probes. Key Points

Economic TimesSEBI set to hand in final Adani report on Hindenburg allegations to Supreme Court

Sources aware of Sebi's probe said this would be a final report and that the regulator's investigation was over. While the exact findings could not be ascertained, SEBI has probed, among other things, whether Adani Group manipulated the share prices of its group companies by exploiting loopholes in the minimum public shareholding (MPS) norms, and whether it failed to disclose related-party transactions. Key Points

Economic TimesCompanies say Sebi's new rules increase compliance load

Companies are struggling to prepare themselves for the new regulations, some of which are in place while others will take effect in the next few months, executives said. The new rules include confirmation or denial of market rumours, disclosing business contracts to family settlements, matters concerning senior employees, new environmental, social and governance regulations, communicating actions taken by any authorities, the companies say. Key Points

Economic Times

Adani-Hindenburg Case: SEBI defends 2019 rule change affecting offshore investors

“Instead, the issue primarily arose from the existence of thresholds for determination of BOs(beneficial owners) In fact, the thresholds were only lowered (i.e., made tighter) between 2014 and 2019,” SEBI said in its affidavit filed before the Supreme Court. Key Points

Economic TimesZEE Row: SAT to deliver order on Punit Goenka's appeal against SEBI interim order on Monday

The Securities Appellate Tribunal (SAT) is likely to deliver its order on Essel Group Chairman Subhash Chandra and ZEEL Managing Director and CEO Punit Goenka's petitions challenging Sebi's interim order on Monday, July 10, reported ET NOW. On June 12, the Securities and Exchange Board of India's (Sebi) in an ex-parte interim order restrained Chandra and Zee Entertainment Enterprises Ltd's (ZEEL) Goenka from holding any directorship or key managerial positions in listed entities on account of alleged fund diversion. Key Points

Economic Times