Forget FOMO, Dinshaw Irani would avoid chemical stocks. Here’s why

Dinshaw Irani says: “Among the commodity players, we do not like the cement space. We think there is enough capacity and beyond, just because of the price discipline that they have, they are managing to go ahead and we have seen that. There have been pullbacks in prices and all that. It is not a comfortable space to be in or the players are fairly stretched on valuations. Key Points

Economic TimesParam Desai’s 4 top picks in largecap and midcap pharma

“We believe that Ciplas Pithampur facility was inspected in February and post that, they got an OAI in August and post that, it has escalated to a warning letter. We believe that it is unlikely that this will escalate further to import alerts, though this may take some time to resolve.” Key Points

Economic TimesMasaba Gupta on parents Neena Gupta and Vivian Richards: 'Everyone tells me I became successful because of them'-Entertainment News , Firstpost

She added, 'Someone once apparently told a friend once that, ‘What does she have to do. Her dad left her hundreds of crores’. I said no, there’s no hundreds of crores. They are being built, but I am building that myself.' Key Points

FirstpostWhere to find value or growth or both in the next two or three years? Sunil Subramaniam explains

“As per capita income grows, we are already seeing the beginning of premiumisation in automotives, in housing. We are seeing high-end properties, high-end cars selling much faster. We believe that that is a segment which is fully not tapped yet.” Key Points

Economic TimesWorld Cup and festivity themes to dominate next 2 quarters; bullish on 4 stocks: Hemang Jani

Market expert Hemang Jani predicts that the upcoming ICC World Cup and festive season will drive consumer demand in the next two quarters, benefiting sectors like QSR, hotels, and aviation. Food prices will be a key monitorable, but short-term spikes have been easily absorbed by the markets. Jani recommends investing in Titan, Indian Hotels, Zomato, and other consumption names like D-Mart. He also suggests considering stocks in the logistics space, such as Blue Dart and VRL Logistics, which are expected to benefit from the growth in consumer demand. Key Points

Economic Times

‘That Christmas’: Everything we know about animated film’s cast, production, release and more

Netflix revealed the voice cast for the animated film that Christmas. Brian Cox voices Santa, alongside Fiona Shaw, Jodie Whittaker, and Bill Nighy in a charming seaside town. The film debuts later this year, adapted from Richard Curtis's children's books. Key Points

Economic TimesGenerative AI is here to stay and will end up creating more jobs, says TCS CFO

“While we maintain margins at a portfolio level, at a deal level, we might take strategic calls and we might choose to go aggressive. that is the strategic call I was mentioning and in the project lifecycle, margins would differ as I had mentioned,” says Samir Seksaria. He also says we are monitoring the macro situation on a month-on-month basis and currently on the month-on-month basis. Key Points

Economic TimesThis Woman Will Decide Which Babies Are Born

Noor Siddiqui founded Orchid so people could “have healthy babies.” Now she’s using the company’s gene technology on herself—and talking about it for the first time. Key Points

WIREDThis Woman Will Decide Which Babies Are Born

Noor Siddiqui founded Orchid so people could “have healthy babies.” Now she’s using the company’s gene technology on herself—and talking about it for the first time. Key Points

WIREDGet into consumer stocks; 2 stocks to buy as metals in a very sweet spot: Sanjiv Bhasin

Sanjiv Bhasin of IIFL Securities recommends investing in consumption stocks like Voltas and Havells. He says real income is going to be generated now from the tier II, tier III, and the smaller rural class, where we are seeing unprecedented growth He is bullish on metals and recommends Vedanta and JSW. Bhasin mentions investments in Indiabulls Real Estate and Indiabulls Housing Finance. Key Points

Economic Times

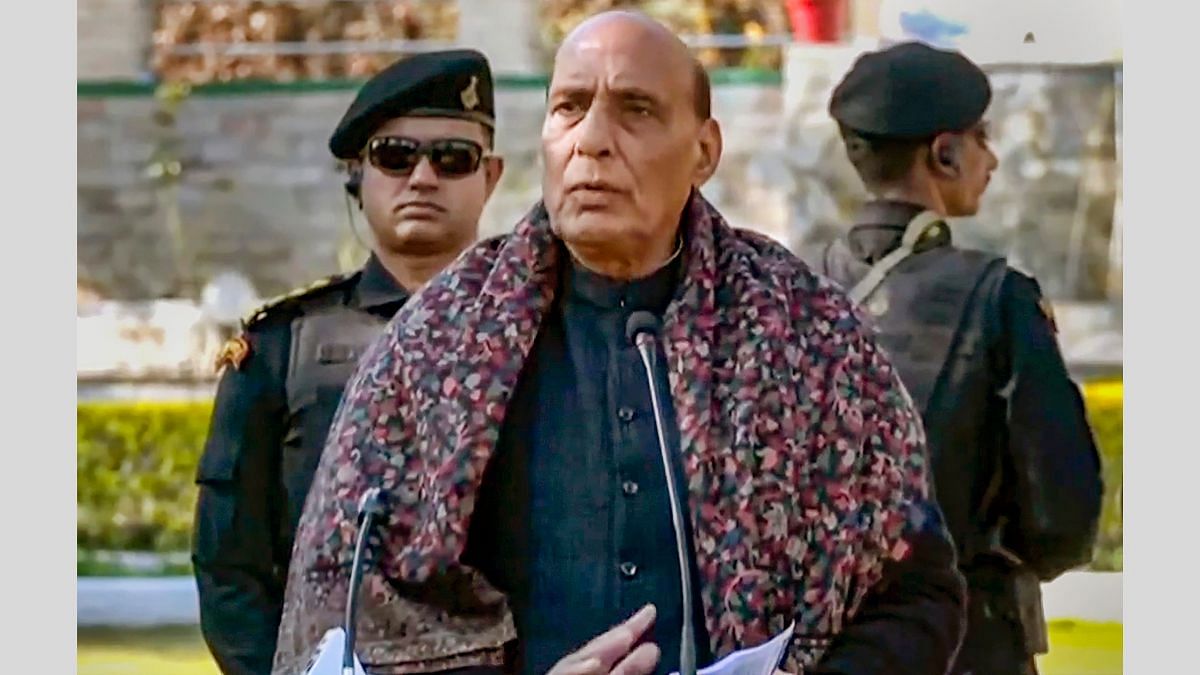

'Army will wipe out terrorism from J&K. Have full faith,' says Defence Minister Rajnath Singh

Singh was addressing troops in Rajouri Wednesday. He was reviewing security situation in wake of recent terrorist ambush in Poonch that left four soldiers dead. Key Points

ThePrintTemper your expectation is Neil Parag Parikh’s main communication to clients

Neil Parag Parikh, Chairman & CEO of PPFAS MF, advises investors to temper their expectations due to the unpredictable nature of equity markets. He highlights the popularity of SIPs among Indian investors and downplays the impact of elections on investment decisions. Parikh also discusses the attractiveness of overseas investments and warns of froth in the small and midcap space. Key Points

Economic TimesJust coming to our own in India; confident of growing our US business in next fiscal year: Lupin managemen

Lupin's margin guidance remains around 19.5-20.5%. The company attributes its success to the pivot to complex products, cost-led initiatives, and positive factors like input cost tailwinds. However, there are potential negatives such as disruptions and freight costs that need to be considered. Lupin is just coming to its own in India and would want to replicate this growth. Key Points

Economic TimesTime to book some profit in real estate, auto stocks and Vodafone; 2 stocks to buy now: Sanjiv Bhasin

Sanjiv Bhasin says: “Be cautious of some of the outstretched valuation and when you get these big brokerage calls of absurd returns, you should be selling. Right now, if I have comfort it is in some of the PSU oil marketing companies, some of the pharma names. And if you want I can suggest two names which I think can outperform from here.” Key Points

Economic TimesAvoid IT, better to focus on PSUs as that remains a strong sector: Rohit Srivastava

“You cannot have a market rally without participation from banking. It is worth paying attention to. But it might not be the outperforming sector. The outperformance may still go back to where it was earlier which is in, say, PSU stocks, for example. Banks have generally been the most beaten down part of the market and Kotak has actually been an underperformer. ” Key Points

Economic Times

Forget Vedanta, look at rest of the metal pack: Daljeet Singh Kohli

Daljeet Singh Kohli, Head of Strategy & Research at Vasuki India Fund, advises retail investors to refrain from buying or staying in Vedanta due to its demerger exercise, which he believes is primarily a debt management exercise rather than value unlocking. He suggests that it may take 12 to 15 months for any major benefit to be realized, making it a long-term investment. However, Kohli remains positive on the metal pack and recommends exploring other options within the sector. He also expresses positivity towards PSU banks. Key Points

Economic TimesCan Israel-Palestine war impact India’s Middle East Corridor plan? Ajay Sahai answers

The role of China and Russia will be very crucial. Iran's support is quite visible, the kind of statement which Iran has issued. And we know Iran's support to Hezbollah groups there. But as of now, both China and Russia have been very diplomatic and they have rightly said that this needs to be contained Iran has some concern, but then Iran should also be equally concerned that any further escalation will take the recent rapprochement with the US off-road as well. Key Points

Economic TimesThere's No AI Without Nvidia. Meet the CEO Powering the Future

Tech companies can’t get enough of this tech company. Earnings are off the charts. WIRED probes the mind of its CEO, Jensen Huang. Key Points

WIREDWhat could be the big themes for 2024? Pawan Parakh answers

Pawan Parakh says: “Banks are one space which should bounce back in the next calendar year. Apart from that, the capex cycle recovery is a theme which is very strong out here. So, industrials, infrastructure is another theme which we think should continue to do well and when I say that, I also include a lot of these allied spaces like power, power ancillary, defence kind of stocks.” Key Points

Economic TimesAnimal: Here's how much the new 'National crush' Tripti Dipri was paid to star opposite Ranbir Kapoor

When asked about the intimate scene and her parents' reaction to it, Dimri told Bollywood Hungama, 'My parents got a little taken aback. (They said) ‘We have never seen something like this in films.' Key Points

Firstpost

Made money in small and midcaps? Book some profit and raise allocation to largecaps: Abhay Agarwal

“Among the largecaps, we have added Reliance, Kotak Bank, Dr Reddy's and Divi's. We are turning quite positive on largecap pharma segment because after years of struggle with pricing and volumes in the US markets and the struggles with US FDA, this is a sector which is now seeing good traction and is very competitive right now.” Key Points

Economic TimesExpect volatility in next 2 quarters be nimble and & capture possible upsides: Dinshaw Irani

Dinshaw Irani of Helios Mutual Fund advises a balanced portfolio approach with lower beta to navigate market volatility. He remains cautious due to weak corporate demand, inventory buildup, and challenges in the IT sector despite industry optimism. He says March quarter numbers will be the first ones where after six consecutive quarters of growth, one may see some kind of cuts getting built into the earnings per se. Key Points

Economic TimesWhy Sudip Bandyopadhyay prefers L&T to Bhel; 4 stocks to look in metal counter

“As things stand today with the metal cycle turning around and considering the price where it is, Vedanta is one stock an aggressive investor can look at taking a bet on for some time. Specifically on aluminium, one can look at Hindalco but one has to remember that these trends change very quickly.” Key Points

Economic TimesLooking for hidden gems? Look into these 3 sectors: Anshul Saigal

Anshul Saigal says some people are holding cash but I would say the majority are not holding cash. What that means is that the majority are not expecting a meaningful correction while some are expecting a meaningful correction. An investor who is looking for defensives should go for FMCGs. An investor who is looking for long-term wealth creation should look at QSRs. And there are now multiple opportunities in that space to make money over the next few years. Key Points

Economic Times90% of the market overvalued except very largecap stocks: Sanjeev Prasad

Sanjeev Prasad says: “Probably 90% of the market is overvalued. While the very largecap names seem to be more reasonably valued, as we go down the market cap quality and risk curve, the extent of overvaluation keeps on increasing and you cannot even understand what is happening in some of the midcap and smallcap stocks.” Key Points

Economic Times

Is outperformance returning to the broader market? Kunj Bansal answers

NISM's Kunj Bansal foresees rural demand growth after elections or government aid. Sectors with attractive valuations lure long-term investors. Short-term traders focus on trading patterns. Recent market movement, crop arrival, smallcaps, midcaps, stock corrections, and equity risks influence investments. Key Points

Economic TimesWait for a dip to buy Tata Chemicals; see value in PSU banks: Vishal Malkan

Vishal Malkan recommends investing in PSU banks like Canara Bank, Bank of Baroda, and PNB. He also mentions AB Capital as a good stock. Bank Nifty has resistance at 48,000. Auto companies like Ashok Leyland, TVS, Bajaj, and Hero should be watched for breakouts and would would wait for Tata Chemicals price to come down to Rs 1040-1045 before buying it. Key Points

Economic TimesIn next couple of days, opportunities may show up in private banks: Rohit Srivastava

Rohit Srivastava identifies FMCG and private banks as the weakest sectors. Short-term bounce back seen in HDFC Bank and ICICI Bank. Nifty and Bank Nifty may have experienced a false breakout. Drop in volumes and critical support levels to watch. PSU stocks show high RSI and potential shorting opportunities in oil and power segments. Key Points

Economic TimesThis report card budget has given positive signals for equity markets: Sunil Subramaniam

The reduction in interest rates in the debt market is leading to increased flow of money into hybrid funds, which provide a tax-efficient way to participate in the reducing debt market. This has positive implications for the private sector as it reduces the crowding out effect of the government, leaving more capital for private sector borrowing. The lower borrowing program announced by the government also reduces pressure on yields, resulting in mark-to-market gains for banks and mutual funds. Key Points

Economic TimesIndian-American murder-suicides: The American dream, broken by death and despair

India News: Discover the shocking truth behind the rise of murder-suicides in the Indian-American community, exposing the hidden underbelly of the American dream. Explore the factors contributing to these tragic events and the urgent need for mental health support. Stay informed with the latest news and analysis on Indian-American murder-suicides. Key Points

Times Of India

Sanjiv Bhasin’s 2 bets on religious tourism; 3 cement stocks to buy

Sanjiv Bhasin says: “When it comes to religious torism, the winners are going to be Indian Hotels and IRCTC. Also, add UltraTech, Ambuja and Dalmia Bharat into your portfolio on this correction. Cement will be a no-brainer right up till the elections and you will see more cause of price hike.” Key Points

Economic TimesExpect some consolidation over the first quarter of 2024: Karthik Kumar

Karthik Kumar says: “My fund has a good mix of PSU banks, private banks, and even non-banking players as well. PSU banks have had a good rally for the year so far. So, to that extent, the valuation differential has narrowed and now it comes down to selecting stocks on a case-by-case basis rather than looking at it as a group, as a whole.” Key Points

Economic TimesIsrael sees gradual transition to next phase of Gaza operations

U.S. Defense Secretary Lloyd Austin said that he was not in Israel to dictate any timeline or terms for Israel's military campaign, but he did discuss making the transition to lower intensity operations. Key Points

Economic TimesIndia's Dr. Reddy's shares fall on observations from US regulator

BENGALURU (Reuters) - Shares of Indian drug-maker Dr. Reddy's Laboratories were down 6.5% on Monday after the U.S. Food and Drug Administration issued three observations for the company's plant in Key Points

ThePrintMidcaps and smallcaps will continue to drive the rally upwards: Deepak Shenoy

“ I continue to think local domestic money that is coming in mid and smallcaps will continue to fuel, it if it has to keep going ahead. From January onwards, results will show us how good the Diwali season is and if Diwali was really good in terms of earnings, we should see the consumer durables or the staple sector start to take more weight in the movements going forward.” Key Points

Economic Times

Sanjiv Bhasin on 3 chemical stocks and a dark horse to bet on now

“In auto, I still would put my money on Maruti for Rs 12,000. Eicher and Hero and Bajaj are the three winners but they are all hitting new highs. So, either you chase new highs, which is a technical breakout or you stay with Maruti. I would put my money in Maruti as well as Eicher.” Key Points

Economic TimesA shift to defensives like FMCG & pharma apparent: Rohit Srivastava

19,450 is going to be the first hurdle that Nifty is facing. We are pretty close to that and once we get past that, we should head towards 19,700. Even in the Bank Nifty, we are very close to the 40-day average, which is around 43,680. We can go towards 43,800 or slightly higher. Key Points

Economic TimesAfter churning out multibaggers, OG fund manager Rajeev Thakkar says it’s time to be a conservative invest

“A Nifty 21 multiple may not seem very, very expensive. But when you look at the individual company valuations, some trading at 70, 80, 100 times earnings or some of the newer listings coming on prospects of future profitability and just focusing on growth, that environment has changed and one should be cautious on that front.” Key Points

Economic Times