ETMarkets Smart Talk: Why financial could turn out to be a dark horse of FY25: Satish Ramanathan

Satish Ramanathan highlights challenges for Indian equity markets in FY25 , including domestic elections, monsoons, food inflation, US elections. Crude oil, inflation, and central banks' actions pose additional risks. Market corrections offer investment opportunities amidst turbulent valuations. Ramanathan says: The recent correction in the mid and smallcap stocks was primarily on account of a sharp rise in valuations and not due to a deterioration in fundamentals. Key Points

Economic TimesETMarkets Smart Talk: FY25 is likely to see private banks doing well along with PSU utilities: Naveen Kulk

FY25 outlook favors private banks, PSU utilities, Pharma, and IT sectors. While largecaps offer decent value even at current levels, the broader market will likely see tepid returns in FY25.Gold's rise, market momentum, and challenges from political risks, credit crises, inflation highlighted. NBFC and real estate sectors face risks. FIIs may target small & midcap stocks with market correction. Key Points

Economic TimesStates' capex focus pivots away from roads to social services

States are expected to reduce their capital expenditure on roads in FY25, focusing more on social services like public health and education. This shift is partly due to the post-pandemic realization of the need to develop human capital. States are also aiming to meet their fiscal targets, with some compromising on road spending to achieve this. While overall spending on roads by states is set to increase, the growth rate is slowing down compared to previous years. The central government is also expected to reduce its spending on roads in FY25. Key Points

Economic TimesBudget 2024: Buoyant tax revenues and expenditure rationalisation to help keep fiscal deficit target of 5.

Interim Budget: HSBC expects the central government to set a fiscal deficit target of 5.3% of GDP in FY25, with buoyant tax revenues and cuts in current expenditure. The government plans to bring the fiscal deficit down to 4.5% of GDP by FY26. Despite higher subsidy spending, the government is likely to meet the fiscal deficit target of 5.9% set for FY24 due to higher tax buoyancy. The government's spending on capital expenditure is expected to be lower than budgeted, contributing to deficit containment. HSBC also predicts that fiscal consolidation will lead to RBI delivering two rate cuts in FY25. Key Points

Economic TimesBudget 2024: 5 key factors investors should watch out for

Budget News: The upcoming Union Budget for 2024 is expected to have implications for investors, with a focus on tax relief measures, capital expenditure, fiscal deficit, subsidies, and market borrowings. Find out the key factors investors should watch out for in Budget 2024. Key Points

Times Of India

Budget 2024 may be interim but investors need to watch out for these 5 things

The upcoming Union Budget, an interim one in an election year, is unlikely to have any spectacular announcements but could still have significant outcomes for investors. The focus is expected to be on tax relief measures to boost consumption and investment, especially for salaried individuals and MSMEs. Key Points

Economic TimesRBI likely to transfer Rs 1,000 billion to govt in FY25

The Reserve Bank of India (RBI) is likely to transfer approximately Rs 1,000 billion to the government in FY25, according to a report by Union Bank... Key Points

The Tribune IndiaEconomists raising India's FY25 growth forecast on good nine-month show

A revival in spending by private enterprises and tailwinds from expected monetary easing sometime later in the year are expected to keep the economy chugging at the current world-beating pace. Growth for the full year FY24 is now seen at 7.6%. An ET poll conducted before the GDP (gross domestic product) data release had pegged FY25 growth at a median of 6.5%, with forecasts ranging from 5.4% to 7.1%. Key Points

Economic TimesInterim Budget: Fiscal deficit target may be set at 5.3% in FY25, say experts

...major policy changes and announcements are unlikely. ICRA expects the fiscal deficit target for FY25 to be set at 5.3% of GDP, midway through the expected print of 6% for FY24 and the medium-term target of sub-4.5% by FY26, said Aditi Nayar, chief economist, Icra. Key Points

Economic TimesInterim Budget may target 5.3% fiscal deficit for FY25: Ind-Ra

Budget 2024: India Ratings and Research (Ind-Ra) stated that the government aims to achieve a fiscal deficit to GDP ratio of 5.3% in FY25. However, it may miss the 5.9% target for FY24 due to a lower nominal GDP growth rate. The government plans to reduce the fiscal deficit to 4.5% of GDP by FY26. Ind-Ra projected a net tax revenue buoyancy ratio of 1.2x in FY25. It also noted a slowdown in capex growth in FY25 and limited scope for revenue expenditure rationalization. Key Points

Economic Times

Eco momentum remains intact: Finance ministry

India Business News: India maintains strong economic activity with a projected real GDP growth of 6.5-7% for FY25, even with erratic monsoon patterns. The finance ministry Key Points

Times Of IndiaExpert view: Nifty 50 could deliver 16% earnings growth in FY25, and largecap 100 too, says Roop Bhootra of Anand Rathi

Expert View: Roop Bhootra, CEO - Investment Services, Anand Rathi Shares and Stock Brokers expects Nifty-50 to deliver 16% earnings growth in FY25. The earnings outlook for small caps as per him still looks the best among all (large, mid, small caps) for 2025-26. Key Points

mintDomestic household savings needs to increase to finance pvt capital formation in economy: Finance Ministry

India needs to bolster domestic household savings to support private sector capital formation, as per the Finance Ministry's Monthly Economic Review. The report anticipates a better current account balance in the ongoing fiscal year due to a reduced merchandise trade deficit and increased net services receipts. However, concerns persist regarding the current account deficit in FY25. Key Points

Economic TimesGovt's capex engines to run at steady speed in future

This level of public capital investment will probably need to be sustained for a long period, Union finance secretary T.V. Somanathan said Key Points

mintADB cuts India’s FY24 growth forecast to 6.4%

FY25, however, is expected to witness faster investment growth, thanks to supportive government policies and sound macroeconomic fundamentals, lower non-performing loans in banks, and significant corporate deleveraging that will enhance bank lending. It forecast 6.7% growth rate for FY25 Key Points

mint

High selloff target can potentially create overhang in the market, says Dipam Secy

In a rare move, the interim budget for FY25 clubbed the government's disinvestment and asset monetisation targets, instead of declaring them separately. The combined realisation is budgeted at Rs 50,000 crore for FY25, against Rs 30,000 crore (revised estimate) in FY24 and Rs 61,000 crore in the BE for this fiscal. Of course, the combined target is still less than 2% of the government's expected non-debt receipts for FY25. Key Points

Economic TimesHousehold consumption to revive in FY25, growth at 6.3%: Standard Chartered

India needs household consumption to pick up for GDP growth of 6% or higher in the coming fiscal. Standard Chartered revised its FY25 forecast to 6.3% from 6%, projecting muted inflation and higher food spending to drive growth. The report expects a revival in consumption to offset the impact of lower commodity prices, slower global growth, and moderation in government capex. Key Points

Economic TimesBudget will be aligned with BJP's thrust on GYAN strategy; capex growth pace may slow slightly in FY25: So

Sonal Varma believes the government will meet its fiscal deficit targets for FY24 and FY25 through offsetting factors and a slight slowdown in capex growth. For FY24, higher direct tax collections and dividends have been positive, while lower indirect tax collections and disinvestment proceeds have been negative. In FY25, Varma expects the government to set a deficit target of 5.3% of GDP based on assumptions of nominal growth and a slowdown in capex growth. Key Points

Economic TimesETMarkets Smart Talk: After a blockbuster FY24, watch out for rupee depreciation and monsoon in FY25: Dr P

Dr. Poonam Tandon provides insights on market volatility, SEBI's valuation concerns, election-driven spending, and the semiconductor industry's growth potential. Investors should focus on quality companies and monitor geopolitical risks for FY25 investments. Dr Tanson says: Given the sharp rally in the broader markets and frothy valuations in a few pockets, our current stance is conservative. Key Points

Economic TimesFY25 outlook bright, need to watch out for CAD: Finmin

India's economic outlook for FY25 is positive with strong growth, stable inflation, and robust external account. The government's capital push boosts private investments. Focus needed on increasing domestic savings, monitoring global challenges, and attracting foreign investments for sustainable growth. Key Points

Economic Times

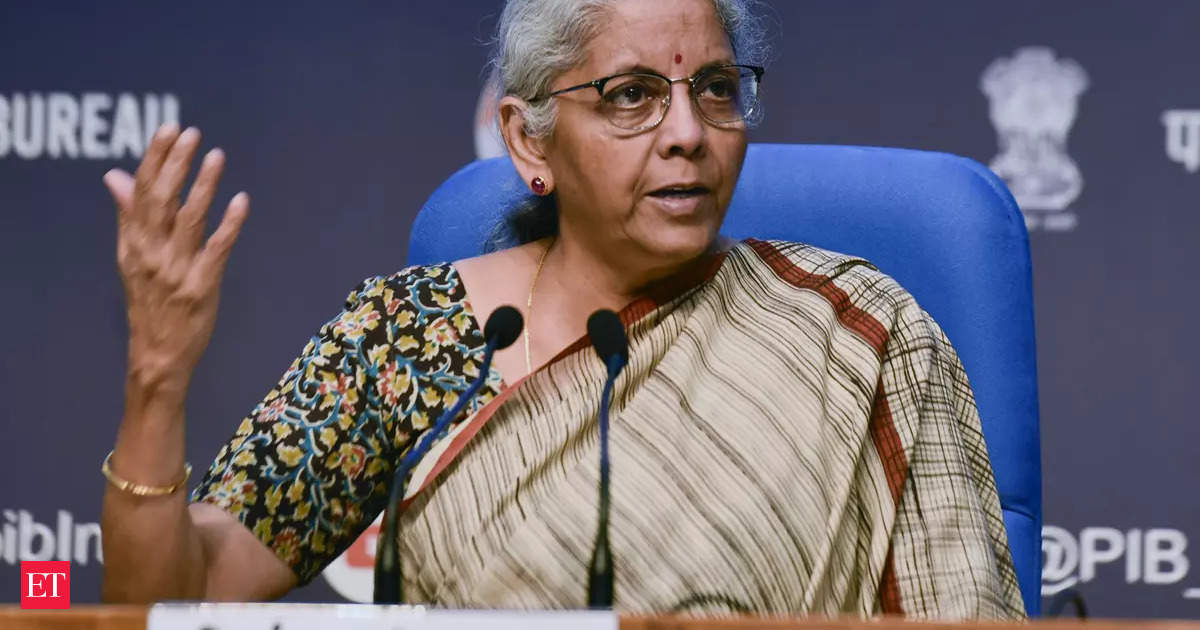

Budget 2024: Focus still on GDP - Governance, Development and Performance

Finance Minister Nirmala Sitharaman emphasized the government's focus on GDP, representing governance, development, and performance. She highlighted achievements such as three consecutive years of 7%-plus growth, India being the fastest-growing economy in the G20, and efforts in inflation management, pandemic response, and infrastructure development. Sitharaman addressed questions about fiscal deficit reduction, capital expenditure, and initiatives for social justice and inclusion. She also noted the government's commitment to fiscal consolidation and the ongoing review of the National Pension System. Key Points

Economic TimesGovt may prune FY25 fiscal gap target to 5.3-5.4% on slower capex

India's fiscal deficit target for FY25 is expected to decrease significantly in line with post-Covid consolidation plans, potentially dropping to a range of 5.3-5.4% of GDP from the current year's 5.9%. Despite a slowdown in capital asset investments, gross market borrowing is anticipated to remain high, with estimates for FY25 around ₹15.3 lakh crore. The reduction in the fiscal deficit target is attributed to a slower pace of capital expenditure, providing room for consolidation. The government is committed to lowering the fiscal deficit to below 4.5% of GDP by FY26. Key Points

Economic TimesBudget 2024: No major moves in budget; capex to normalise, fiscal deficit at 5.3% in FY25, say economists

“…major policy changes and announcements are unlikely. ICRA expects fiscal deficit target for FY25 to be set at 5.3% of GDP, midway through the expected print of 6.0% for FY2024 and the medium-term target of sub-4.5% by FY26,” said Aditi Nayar, chief economist, Icra. Key Points

Economic TimesLending rates to start easing only in second half of FY'25: Report

Bank deposit rates are unlikely to rise further. But the structural shift in the system will keep downward rigidity intact. Hence, banks lending rate is expected to remain high in FY25 with some modest softening towards the end. Key Points

Economic TimesFitch says fiscal prudence unlikely to impact India’s sovereign rating

Fitch expects India's sovereign rating to remain unchanged despite the government's efforts for fiscal consolidation. The general government debt is projected to stay above 80% of GDP over the next five years, with a deficit reduction target of 4.5% by FY26. Fitch's forecast indicates a deficit ratio of 5.1% in FY25, and GDP growth of 6.5%. The government's focus on capex investment is expected to support the growth outlook in FY25, with a planned expenditure of Rs 11.11 lakh crore, representing a 16.9% increase from FY24's revised estimates. Key Points

Economic Times

PSU bank stocks rally in a muted market. Why are bulls rejoicing?

Yields on government bonds slumped after Finance Minister Nirmala Sitharaman pegged the gross and net market borrowing for FY25 at Rs 14.13 lakh crore and Rs 11.75 lakh crore, respectively. Most experts had pegged the gross market borrowing to be a little over Rs 15 lakh crore. Key Points

Economic TimesGross borrowing to be pegged at Rs 15.3 lakh crore for FY25; fiscal deficit at 5.5%: SBI Research

The government plans to reduce gross borrowing to Rs 15.3 lakh crore in FY25, targeting a fiscal deficit of 5.5% of GDP. SBI researchers believe that net market borrowing will be around Rs 11.7 lakh crore, resulting in gross borrowings of Rs 15.3 lakh crore after repayments. Adjustments and switches may lower the borrowing to less than Rs 15 lakh crore. Key Points

Economic TimesInd-Ra raises India's FY25 GDP growth estimate to 7.1 pc: Strong government-private investment propel econ

India Ratings and Research (Ind-Ra) has revised India's GDP growth estimate for FY25 upwards to 7.1 per cent, exceeding the Reserve Bank of India's forecast of 7.0 per cent. The agency's outlook is supported by government capital expenditure and a revival in private sector investment. Challenges include uneven consumption demand and export sector obstacles. Despite positive indicators, constraints remain, such as high inflation and geopolitical uncertainties affecting exports. Key Points

Economic TimesRailways raises FY25 loco production target by 27 per cent

According to the latest plan, 1,300 WAG 9H locomotives will be made annually in FY26 and FY27, while 200 units of the WAP 7 variant will be manufactured every year in this period. Besides locomotives, the production plan for 50 Amrit Bharat trains has also been approved for FY25. This will mean production of 1,230 coaches at the production units of the railways. Key Points

Economic TimesIndia Budget 2024: Key takeaways from Modi 2.0's last finance bill

India's interim Budget disappoints taxpayers with no changes to tax structure. However, the government focuses on fiscal consolidation, capital expenditure, and social welfare services. Finance Minister Sitharaman aims to reduce fiscal deficit to 4.5% of GDP by FY26. Revised fiscal deficit target is 5.8% of GDP for FY25. Here are the other top takeaways from the Interim budget Key Points

Economic Times

Sharpen focus on education and health this Budget, experts urge FM

Although the pandemic is behind us, the focus on the health sector shouldn't be diluted, he added. There were also suggestions to tightly monitor the implementation of all such social sector schemes, he added. Facilities at schools and hospitals need to be further improved and vacancies filled up on time, some of them said in the meeting. In the interim Budget for FY25 in February, the government had pegged the outlay for the Ministry of Health and Family Welfare at ₹90,659 crore, up marginally from the FY24 budget estimate of ₹89,155 crore. This outlay also includes spending on health research. Key Points

Economic TimesIndian IT stare at bleak holiday quarter on grim outlook

Over the past two weeks, the likes of Microsoft, Alphabet, Amazon and even Meta, Apple and Tesla have indicated a weakening demand environment that could last at least two quarters. Even Microsoft gave a cautious outlook despite strong performance. Key Points

Economic TimesWeek Ahead: RBI Policy, auto sales, Q4 updates, global cues among key market triggers in first week of FY25

In the first week of the new fiscal, analysts expect volatility to remain high with the scheduled MPC’s policy meet. The momentum will largely depend on the Nifty 50's alignment and the banking index. Key Points

mintBudget 2024: Experts expect FM Sitharaman to set 5.3% fiscal deficit target for FY25

Budget News: Experts expect FM Sitharaman to set a 5.3% fiscal deficit target for FY25 in Budget 2024. The government aims to align with the fiscal consolidation plan until 2026 by normalizing capital spending and refraining from major announcements in the interim budget before the general elections. Key Points

Times Of IndiaIn FY26, expect at least 50% growth on FY25 numbers, says Kaynes Tech CFO

Kaynes Tech expects a 40-50% growth in FY26 with semiconductor and PC board revenues. The company's order book, capacity expansion plans, and focus on addressing challenges position it for sustained growth in the future. CFO Jairam Sampath says the company needs to leapfrog into the higher-end semiconductors so that they are future-proof. Key Points

Economic Times

Interim budget: Govt likely to give populist spending a pass ahead of general election

Interim budget: While the numbers are being worked out, the Centre may peg its FY25 fiscal deficit at the current fiscal level (budgeted at ₹17.87 lakh crore) or even reduce it, said one of the persons cited. This would lead to a meaningful cut in the fiscal deficit relative to nominal GDP that's expected to expand at a double-digit pace in FY25, one of the officials told ET. Key Points

Economic TimesModi govt's FY25 revenue receipt looks gloomy. For every rupee earned, it will spend Rs 1.54

The government continues to reap rich harvests from RBI's bounty. Dividends are expected to remain broadly in line at Rs 1.02 lakh crore in FY25 BE. Key Points

ThePrintRBI likely to transfer Rs 1 lakh crore to govt in FY25

The Reserve Bank of India (RBI) is expected to transfer around Rs 1 lakh crore to the government in FY25, as per a report by Union Bank of India. This projection reflects a slight increase from the Rs 874 billion transferred in the previous fiscal year. The report anticipates a robust dividend payout for FY25, with analysts predicting a potential positive surprise similar to the previous fiscal year. Despite various factors influencing RBI's dividend calculation, such as interest earnings and foreign exchange gains, analysts foresee strong dividend figures. Key Points

Economic TimesWhere is Nifty50 headed in April? See what history has to tell about D-Street action

FY25 has started positively for equities, with strong capital flows and Nifty50's 27% gains in FY24. Bulls are likely to dominate Dalal Street in April amid key events like RBI's monetary policy and general elections. Key Points

Economic TimesRBI MPC: SBI says rate cuts might take place only in Q3 FY25

RBI MPC meeting: The SBI report added that inflation is expected to decline till July, but increase after that to reach a peak of 5.4 per cent in September, followed by a deceleration. Key Points

Business Today

FY25 Outlook: Can Nifty 50 repeat the feat of FY24? 5 crucial challenges that loom

FY25 Outlook: Indian stock market benchmarks Sensex and Nifty 50 ended FY24 with gains of 29 per cent and 25 per cent respectively. Challenges for Nifty 50 in FY25 include rate cuts, earnings, geopolitical tensions, etc. Key Points

mintETMarkets Smart Talk: Big money made when a midcap/ smallcap stock is in Nifty100 league: Sameer Kaul

Sameer Kaul advises caution on high valuations and recommends quality large-cap investments. FY25 may not repeat FY24 returns. Various sectors show promise. Gold prices hit record highs. RBI emphasises stronger credit standards and KYC norms. Kaul says: We continue to advocate a disciplined approach of regular investment and refrain from the temptation of putting a qualitative tag on the market regarding its worth or the lack of it Key Points

Economic TimesIt may take RBI few more months to start cutting rate: Roopali Prabhu of Sanctum Wealth

Roopali Prabhu, CIO and Head of Products and Solutions at Sanctum Wealth, said that it may take a few more months for the RBI to start cutting the rate. She also expects global cues to be a factor in the timing of the rate cut. Key Points

mintFiscal deficit target of 4.5% of GDP by FY26 a challenge: Fitch

India's government faces challenges in meeting its fiscal deficit target of 4.5% of GDP in FY26, according to global ratings agency Fitch. The agency predicts a 6.5% growth in the Indian economy in FY25, supported by 11% growth in government capex. The government has set a 5.1% fiscal deficit for FY25, down from 5.8% in FY24. Fitch expects the new government to maintain the fiscal path laid down in the interim budget. Key Points

Economic TimesIs more trouble on the anvil for UPL?

The UPL Ltd’s stock slipped as much as 11% on Monday, hitting a fresh 52-week low of ₹470.05 apiece. Key Points

mint

IMF revises India’s FY25 growth forecast upward to 6.5%

The finance ministry in its economic review before the budget has projected Indian economy to grow close to 7% in FY25. The multilateral institution projected Indian economy to grow 6.7% in FY24. The first advance estimate released by the government earlier this month pegged FY24 growth at 7.3%. Key Points

Economic TimesFY25 Capex target for CPSEs may rise by 12-13%

The Indian government is expected to increase the capital expenditure target for central public sector enterprises (CPSEs) in the fiscal year 2025 by 12-13%. The capital expenditure for 54 CPSEs and five departmental arms, including the Railway Board and National Highways Authority of India, is projected to be around ₹8.20-8.30 lakh crore for the upcoming fiscal year. Key Points

Economic TimesNifty 50 valuations are rich, offer 8-10% upside in 2024, says HDFC Securities; lists out stocks to accumulate next year

The Nifty 50 index is now trading at ~23x FY24 and ~20x FY25 consensus EPS, indicating limited upside potential in the next 12 months, said the brokerage house. It believes growth hereon will be volume led while the margin expansion story is largely over. Key Points

mintGoing global good for IndiGo as home turf to get crowded

ET Intelligence Group: InterGlobe Aviation's decision to expand its presence on international routes is timely considering the rising competition in the domestic market where it already controls over 60% share. Given the factors such as network expansion, capacity deployment, and a possible benefit of tax loss, analysts have raised the earnings per share (EPS) forecast for FY25 by as much as 38% (Emkay). Key Points

Economic Times