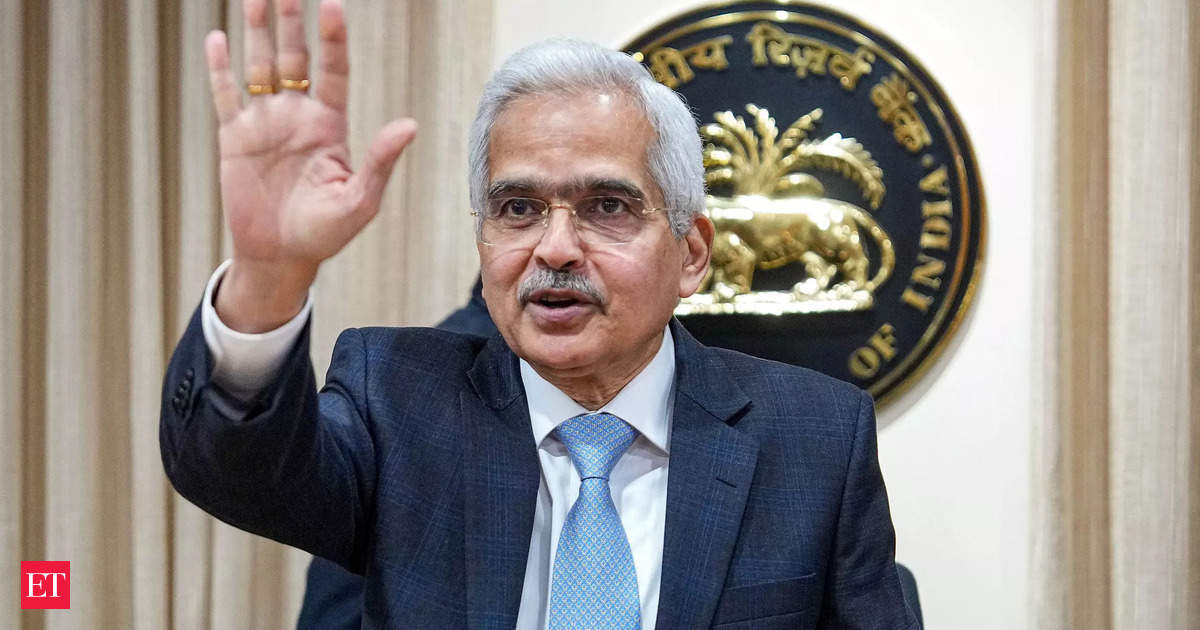

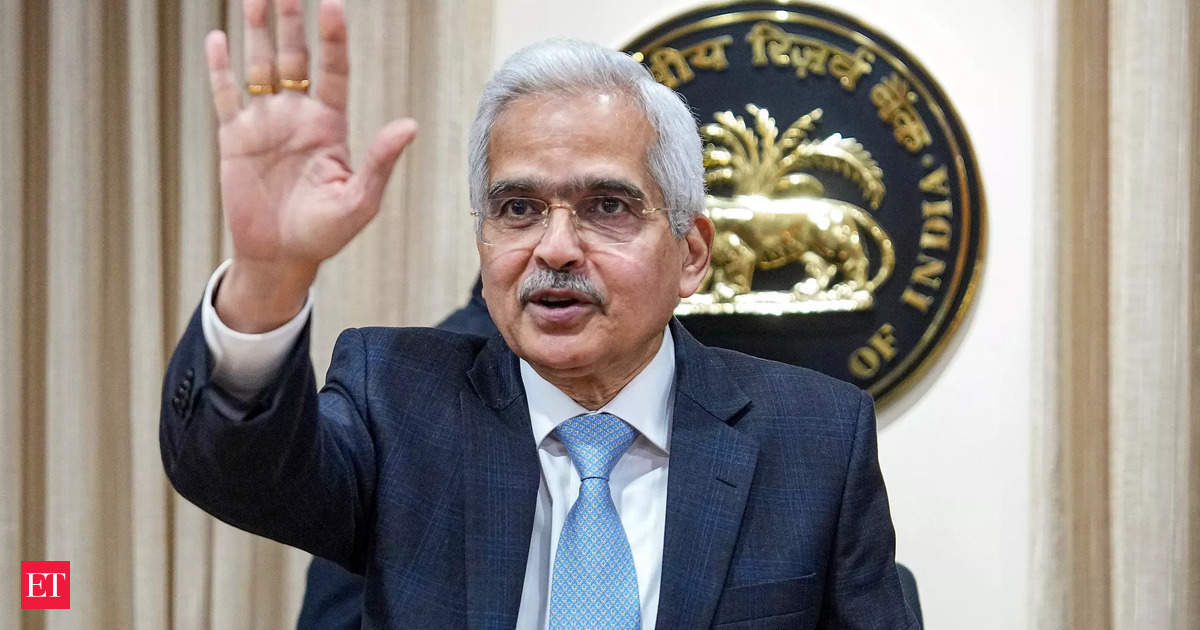

No plans to allow business houses to promote banks: RBI Governor Shaktikanta Das

Governor Shaktikanta Das on Friday said the RBI does not have any plan to allow business houses to promote banks at present. Allowing corporate houses to... Key Points

The Tribune IndiaCoordination with govt helped fast revival of economy: RBI Governor

Governor Shaktikanta Das on Friday said the Reserve Bank of India’s (RBI) relations with the government have been “smooth” during his nearly... Key Points

The Tribune IndiaWomen, booze & a quarrel — Kerala cops probe moral policing angle in migrant worker's lynching

According to Ernakulam police, Ashok Das had gone to visit woman, a former co-worker, in Valakam village near Muvattupuzha. 10 people have been booked for murder, so far. Key Points

ThePrintYou may have Ferrari, but still have to obey traffic rules: RBI head Shaktikanta Das on Paytm

RBI Governor Shaktikanta Das emphasizes support for Fintech while clarifying the action against Paytm Payments Bank (PPBL) as a response to non-compliance. He stresses the necessity of regulatory adherence using an analogy of owning a Ferrari but obeying traffic rules. Das confirms the March 15 deadline for PPBL wallet linkage and expects NPCI to decide on the Paytm payment app license soon. Key Points

Economic TimesRBI Guv Shaktikanta Das sees India growing close to 8% in FY24

RBI Governor Shaktikanta Das expects India's economic expansion in FY24 to be close to 8%, higher than official estimates. He clarified that recent RBI action was targeted at Paytm Payments Bank, not fintech companies. Internal surveys indicate high capacity utilisation and expectations of private investment picking up. Key Points

Economic Times

RBI Governor Shaktikanta Das highlights main challenges in inflation fight

Reserve Bank Governor Shaktikanta Das has emphasized the importance of stable and low inflation for sustainable economic growth. He highlighted that India has successfully navigated through multiple challenges and emerged as the fastest-growing large economy. The Reserve Bank projects India's economy to grow by 7.0% during 2024-25, marking the fourth consecutive year of growth at or above 7%. Key Points

Economic TimesRam Mandir: The key men who defied odds in India’s longest property dispute

Raghubar Das was a mahant of the Nirmohi Akhara, who moved a local court in 1885 for permission to build a'mandap' for Rams worship on the ‘chabutra, or platform, in front of Babri Masjid. He had to move the Faizabad district court after his plea was rejected. And, the same thing happened again, as the judge ordered status quo, saying it was too late to amend a “mistake committed over 350 years ago”. Key Points

Economic TimesIndia far better placed to deal with geopolitical challenges, says Shaktikanta Das at Davos

Geopolitical flashpoints are continuing, new flashpoints are coming out. Supply chain bottlenecks have not fully normalised. Inflation has been brought under control but individual countries have not reached their targets. The last mile is proving to be very difficult, the RBI Governor said. Key Points

Economic TimesRBI Guv reiterates opposition to crypto, days after US permits bitcoin ETFs

Last week, the US SEC approved ETFs based on bitcoin, a move that sent cryptocurrency prices soaring worldwide. Das has steadfastly maintained over the years that cryptocurrencies pose immense threats to currency and monetary stability and could be the source of the next major global financial crisis. Key Points

Economic TimesIndia not to be swayed by US nod for cryptocurrencies: RBI Governor

Says the central bank will not emulate others on regulations. RBI Governor Shaktikanta Das on Thursday said India will not emulate others on the issue of... Key Points

The Tribune India

5 years of Shaktikanta Das: How a humble Guv calmed a turbulent RBI

Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), faced a challenging role when he joined five years ago amidst a government-RBI conflict. Tasked with stabilising after his predecessors' - Raghuram Rajan and Urjit Patel - disputes with the government, Das aimed to restore confidence and stability to the RBI. Key Points

Economic TimesRBI policy: Tone’s hawkish, and there’s nothing ‘inadvertent’ about it

We do not communicate anything inadvertently, let me make it very clear, Governor Das told reporters during the customary interaction after the latest policy review that was earlier interpreted as setting the stage for an easing of monetary policy. If somebody is assuming it's a signal to move toward a neutral stance, I think it will be incorrect. Key Points

Economic TimesNifty crosses 21,000 for 1st time as RBI keeps repo rate unchanged

The Nifty 50 rose to an all-time high of 21,006.10 soon after Reserve Bank of India Governor Shaktikanta Das announced that the central bank’s Monetary Policy Committee decided to keep the repo rate unchanged at 6.5 per cent. Key Points

India TodayFather of a Asim Das, accused in Mahadev app scam, found dead in Chhattisgarh

The body was found in a well at Achhoti village Tuesday afternoon. Police are suspecting it to be a case of suicide. Key Points

ThePrint'But he made sure it was fixed..': Fans rejoice after Vir Das performs in Bengaluru despite technical glitch

According to a dentist named Manavi Raj, Vir Das's 5 p.m. program in Bengaluru hit a technical glitch. Nonetheless, he made certain that it was repaired and continued with the program. Key Points

Business Today

Accused in Mahadev app case retracts statement against Baghel

Asim Das, a driver arrested in the Mahadev gambling app case, has retracted his statement implicating Chhattisgarh CM Bhupesh Baghel, claiming he is a scapegoat. Das was arrested by the ED earlier this month for allegedly delivering money to politicians for election funding. The Congress party has accused the ED of targeting the government. Das has written a letter to the court stating he was wrongly implicated and coerced into signing a statement. CM Baghel has denied the allegations and accused the BJP and ED of conspiracy. | Latest News India Key Points

Hindustan TimesVir Das shares his 'real moments with long captions' from Emmy Awards

Vir dropped his 'Ten of mine' moments on Instagram and wrote, "Fancy pics aside, It's about very real moments, so here's Ten of mine with long captions to hopefully make you feel what it was like to be there for the Emmy's. Solid cookie." Key Points

Hindustan Times66-year-old man loses Rs 1.52 crore in courier scam, here is what happened

A 66-year-old senior citizen in Bengaluru has become the latest victim of the notorious courier scam, losing a staggering Rs 1.52 crore to fraudsters who posed as law enforcement officials. Here is what happened. Key Points

India Today‘One life is not enough’, says Jatin Das

Jatin Das's range of work is phenomenal. He carved a distinctive path, human figures being the central theme in most of his work. Key Points

Hindustan TimesIndia and Japan may look at linking fast payment systems, says RBI governor

Reserve Bank of India Governor Shaktikanta Das said India may explore linking their Unified Payments Interface (UPI) with Japan's fast payment system for more efficient and cost-effective cross-border payments. This move follows a successful real-time linkage between UPI and PayNow with Singapore earlier this year. Key Points

Economic TimesRBI ‘closely’ watching high attrition at some private banks: Shaktikanta Das

Says geopolitical uncertainty is the biggest risk to global growth and India is better placed to deal with any potentially risky situation. RBI Governor Shaktikanta Das on Tuesday said attrition is seen to be high at some private sector banks and that the central bank is watching the issue “closely”. Key Points

The Tribune India87 pc of Rs 2,000 notes back in banks, Rs 12,000 cr of currency yet to return, says Shaktikanta Das

Reserve Bank Governor Shaktikanta Das announced that 87% of the Rs 2,000 denomination notes being withdrawn have been returned as bank deposits, while the rest has been exchanged. He also stated that Rs 12,000 crore worth of Rs 2,000 notes are yet to come back. The RBI is focusing on the 4% inflation target and will maintain an actively disinflationary monetary policy until inflation decreases. The RBI flagged the issue of personal loans and urged banks to take steps to prevent any risk build-up. Gross non-performing assets have improved in the June quarter. Key Points

Economic Times'Deliberately indifferent': Consumer panel order to Byju’s to refund 'dissatisfied' customer Rs 65k

Hooghly Consumer Disputes Redressal Commission also ordered firm to pay student's father Rs 5k for causing mental agony. Order issued ex-parte as Byju’s only submitted written response. Key Points

ThePrintRBI 'not comfortable' with NPAs in urban co-op banks, asks lenders to focus on governance

Das also expressed the RBI's discomfort with board committees like those handling important functions, such as audit and risk not meeting regularly, stating that it has come across instances where such meetings are not held for months or even multiple years. He also asked UCBs to monitor asset-liability mismatches, follow transparent accounting practices and recruit people based on requirements and ability to spend. Key Points

Economic TimesPrivate sector should also fund GPGs to aid inclusion: Shaktikanta Das

Keeping in mind very large investment requirements for setting up global public goods (GPGs), trigger financing could come from public investment, which would minimise risk and widen market access, Das said. “Subsequent financing needs can be met by the private sector. Key Points

Economic Times

Don't camouflage stress, extend loans for reasonable period: Shaktikanta Das to banks

India's Reserve Bank Governor, Shaktikanta Das, has called on banks not to camouflage stress and extend loans only for a reasonable period of time. The borrower's age and ability to repay must be considered, whilst extending loan tenors, he said. Retail loans including long-tenor housing loans, have been extended to longer periods due to rate hikes imposed by the RBI. Key Points

Economic TimesSabyasachi Das' paper is ground breaking. But 'democratic backsliding' is gross exaggeration

Sabyasachi Das asked a good and an important question. This is the job of academics. But a single paper is hardly the final truth. It’s a fragment of a broader puzzle. Key Points

ThePrintRBI Policy: Repo rate left unchanged at 6.50%, but D-Street hit by incremental CRR on banks

While the policy stance was on the expected lines, the RBIs decision to impose an incremental Cash Reserve Ratio (CRR) of 10% of NDTL on banks dampened Dalal Streets mood. The incremental CRR has been imposed for May 19-July 28 period, and the RBI will review the same on September 8, Das said, adding that the move is “purely” a temporary measure. Key Points

Economic TimesPM Narendra Modi’s tribute to Madan Das Devi

A few days ago, when we lost Shri Madan Das Devi Ji, lakhs of Karyakartas, including myself, were saddened beyond words. It's a challenging reality to grapple with – the idea that a personality as impactful as Madan Das Ji is no longer among us. Yet, we are consoled by the knowledge that his i Key Points

The Tribune IndiaBarclays India head to join Centrum Group as the head of its wealth management

Sandeep Das, the India head of private banking clients at Barclays, is set to join Centrum Group as head of its wealth management subsidiary, Centrum Wealth, amid a top-deck reshuffle. Das, who has over three decades' experience, will fill a leadership void left by the removal of two managing directors last year due to loss of confidence . Key Points

Economic Times

Ex-Tamil Nadu top cop gets 3 years imprisonment for sexually harassing woman officer

Senior Tamil Nadu cop Rajesh Das was sentenced to three years in jail for sexually harassing a junior officer while on duty. A fine of Rs 10,000 was also imposed on him. Key Points

FinancialexpressShaktikanta Das: Disinflation process likely to be slow, but economy remains among fastest growing in 2023

RBI Governor Shaktikanta Das has said that India's disinflation process is likely to be slow and protracted, despite CPI inflation reaching a two-year low of 4.25%. He believes India will remain among the fastest growing large economies in 2023. Key Points

mintGovernance gaps found in some banks have potential to cause volatility, Shaktikanta Das says

Good corporate governance is a basic requirement for keeping the banking system safe and sound, Das observed. Effective governance is of critical importance for trust, long-term stability and business integrity of banks, the Governor said. Key Points

Economic Times‘Monitoring the situation regularly, entire process to be non-disruptive’

"Yesterday there was no crowd anywhere. We are monitoring the situation regularly. I don’t think there is any concern or major issue which is coming off. Trade and business activities are going on,” Das said at an event organised by Confederation of Indian Industry (CII). Key Points

The Indian ExpressIndia's GDP growth may breach 7%-mark in FY23: RBI Governor Das

India's gross domestic product growth could be above 7% for 2022-23, the Reserve Bank of India Governor Shaktikanta Das said. There is also a possibility that GDP growth for the last financial year could be higher, he said. Financial markets remain volatile owing to uncertainty over future monetary policy path is keeping market sentiments on the edge, said Das. Key Points

Economic Times

Odisha bypoll | BJD candidate registers landslide victory over BJP rival in Jharsuguda

Dipali Das secured a total of 1,07,198 votes, while Tankadhar Tripathy bagged 58,477 votes. Congress candidate Tarun Pandey came third with 4,496 votes, the Election Commission official said. Key Points

The HinduCooling of CPI very satisfying: Shaktikanta Das

CPI inflation eased to 4.7% in April from 5.7% in March, the latest data showed. Key Points

FinancialexpressInflation numbers show monetary policy's on the right track: RBI Governor Shaktikanta Das

The recent drop in India's Consumer Price Index (CPI) indicates that the monetary policy is on the right path, according to Reserve Bank of India Governor Shaktikanta Das. The CPI inflation rate reached an 18-month low of 4.7% in April, down from 5.7% in the previous month. The central bank has raised the repo rate by 250 basis points since May 2022 to meet the 4% CPI target. Key Points

Economic TimesInflation cooling very satisfying; confident that monetary policy is on right track: RBI Governor

Admitting that there is a statistical base effect, Das said one must speak to any entrepreneur to understand the growth momentum of higher sales every month. Das said private investments are also picking up, and enlisted steel, cement and petrochemicals as among the sectors where this is seen. If India grows at 6.5 per cent, it will contribute 15 per cent of the world growth in the year, Das said, stressing that this is no mean achievement. Key Points

Economic TimesTwo held for murder of man in Worli

According to the police officials, the incident took place late on Tuesday. An officer said, "Das allegedly demanded sexual pleasure from the wife of an accused identified as Sachin Rangaswamy Kawandar. Das allegedly offered Rs 500 in return." Key Points

The Indian ExpressRBI looking at Indian banks’ business models “more closely”, says Shaktikanta Das

Poor business models may have triggered crisis in U.S. banks, Reserve Bank of India looking at Indian banks’ business models “more closely”, says Governor Shaktikanta Das Key Points

The HinduWhen Swami Gaur Gopal Das thought he was meeting Modern Family's Sofia Vergara, but...

Swami Gaur Gopal Das recollected an event in Singapore where he was a keynote speaker. Soon after his speech, the crowd started shouting 'Sofia, Sofia'. Key Points

Business TodayBT Mindrush 2023: Curiosity to know, but vulnerability to accept ignorance greatest quality in a CEO, says motivational guru Gaur Gopal Das

“A lot of times the blindspot of achieving success is to feel that I have cracked it and I know it. However, innovation, creativity and growth comes from curiosity,” he added. Key Points

Business TodayA monetary policy review that didn't happen

Financial markets, in the business of reading the future from the present, were excited that interest rate increases are behind after the RBI did not raise rates. But Governor Shaktikanta Das snatched the candy back in less than a minute. Key Points

Economic Times